Data Science for Business Applications

Class 01 - Linear Regression Review

What is Data Science?

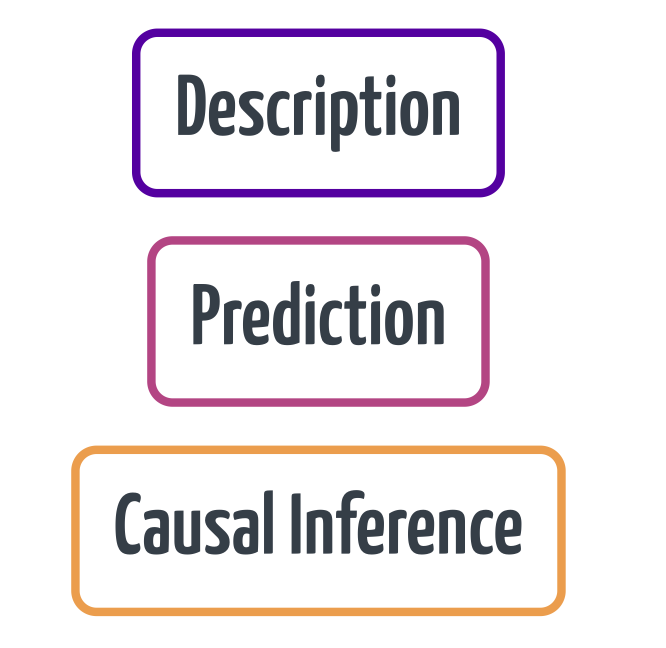

- In Data Science we use the available data to obtain:

Data Science tasks

- Description: Can we classify our customers into different segments? (simple task)

- Prediction: What is the probability of a shopper coming back to our website? (kind of a simple task)

- Causal Inference: What is the effect of increasing our advertising budget on our total revenue? (difficult task)

Simple and Multiple Regression

- Linear Regression will be the most important tool for solving these Data Science tasks.

- Basically, in the linear regression model, we are explaining the relation between different variables by a line (that’s where the linear comes from.)

- Many fancy methods are generalizations or extensions of Linear Regression!

- In this class, we will do a quick review on linear regression.

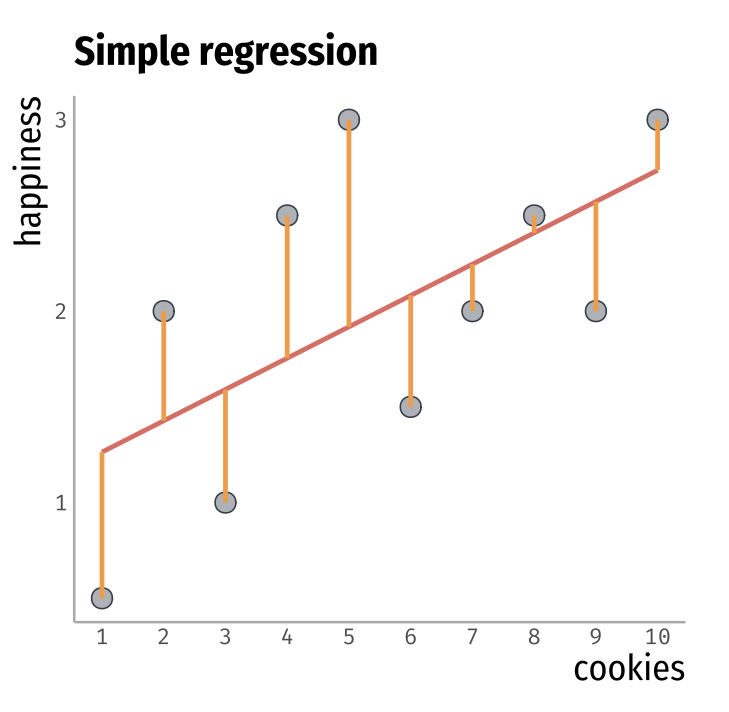

Cookie Example

- Suppose we have some data, and we want to understand how happiness changes in relation to the number of cookies eaten.

- To do so, we summarize the relation between these two variables through a line.

- This line is the linear regression line.

- Let’s see how this works!

| cookies | happiness |

|---|---|

| 1 | 0.1 |

| 2 | 2 |

| 3 | 1 |

| 4 | 2.5 |

| 5 | 3 |

| 6 | 1.3 |

| 7 | 1.9 |

| 8 | 2.4 |

| 9 | 1.8 |

| 10 | 3 |

Cookie Example

- The regression line is defined by two values, the intercept and the slope.

- The intercept is where the line intercepts the happiness axis.

- The slope relates to the inclination of the line.

- If the slope is positive the line has a upward direction.

- If the slope is negative the line has a downward direction.

- The regression line is a model of the relation between happiness and the number of cookies eaten.

Some questions on regression

- From the regression line, what is the relationship between happiness and the number of cookies eaten?

- Are there other factors other than the number of cookies that might affect the happiness level?

- From this model, can we conclude that eating cookies alone causes happiness?

- Why not look only at the correlation between happiness and the number of cookies?

- How do we obtain the intercept and the slope?

- Does this result apply to the entire population?

Regressions Details

- The Linear Regression model is represented by the formula: \[ Y = \beta_0 + \beta_1\cdot X_1 + \beta_2\cdot X_2 + e \]

- Multiple Regression means we have two or more \(X\)’s.

- Let’s break down this model into its essential parts.

Essential Parts of a Regression

- \(Y\) - Outcome Variable, Response Variable, Dependent Variable (Thing you want to explain or predict)

- \(X\) - Explanatory Variable, Predictor Variable, Independent Variable, Covariate (Thing you use to explain or predict \(Y\))

- \(\beta\)’s - Coefficients, Parameters (How \(Y\) changes numerically in relation to \(X\))

- \(e\) - Residual, Noise (Things we didn’t account in our model)

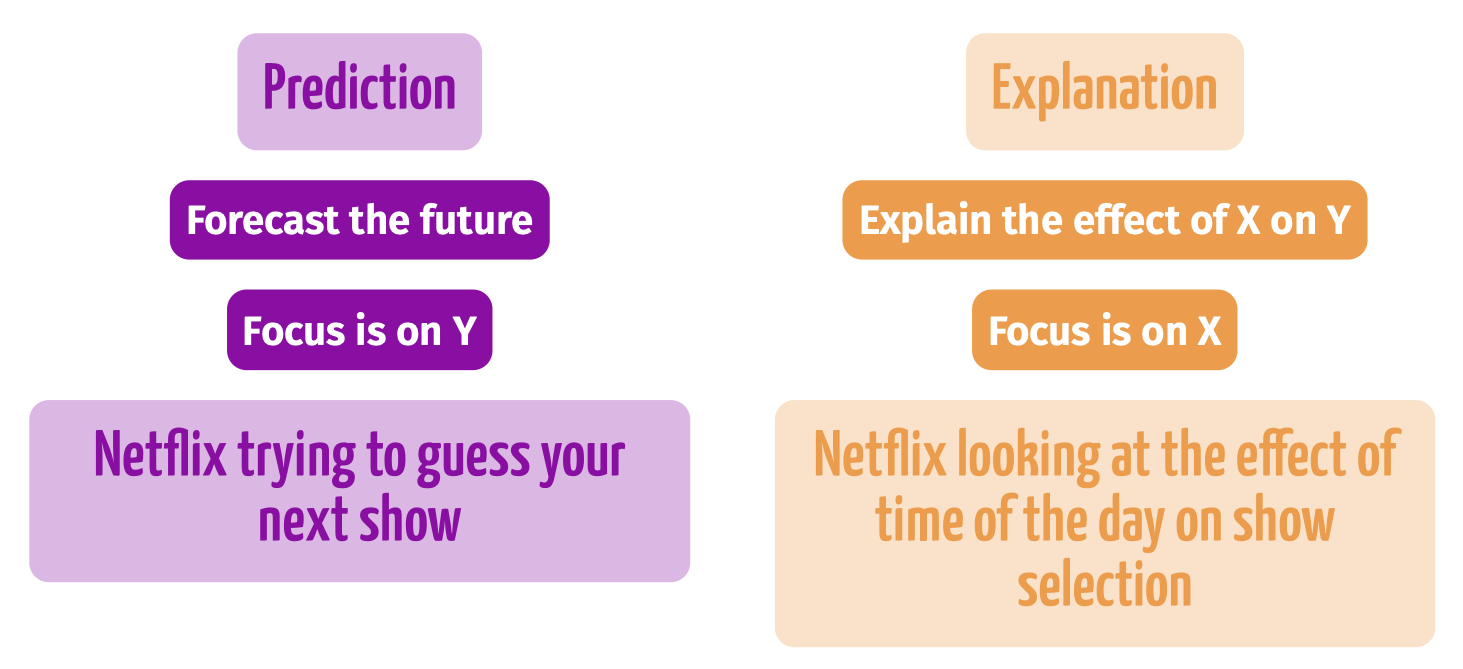

Two Purposes of Regression

Back to the Cookie example

- By writing the cookie example as a model where the variable happiness is the response variable and the number of cookies is the predictor, we have \[ \texttt{happiness} = \beta_0 + \beta_1\cdot\texttt{cookies} + e \]

happinessis the response variable (\(Y\)).cookiesis the predictor variable (\(X\)).- \(\beta_0\) is the intercept.

- \(\beta_1\) is the slope associate to the

cookiesvariable. - \(e\) are the unknown factors that might explain the relation between cookies and happiness.

- The challenge now is to estimate the parameters \(\beta_0\), and \(\beta_1\).

How do we estimate the coefficients in a regression?

- A very useful strategy is use what is called the Ordinary Least Squares (OLS).

- The method is called ordinary least squares because the algorithm selects the coefficients (\(\beta\)’s) that minimize the sum of the squares of the errors in our sample.

- So the data in this case is fundamental.

- We use R to learn \(\beta\).

- The estimated coefficients are referred to as \(\widehat{\beta}\).

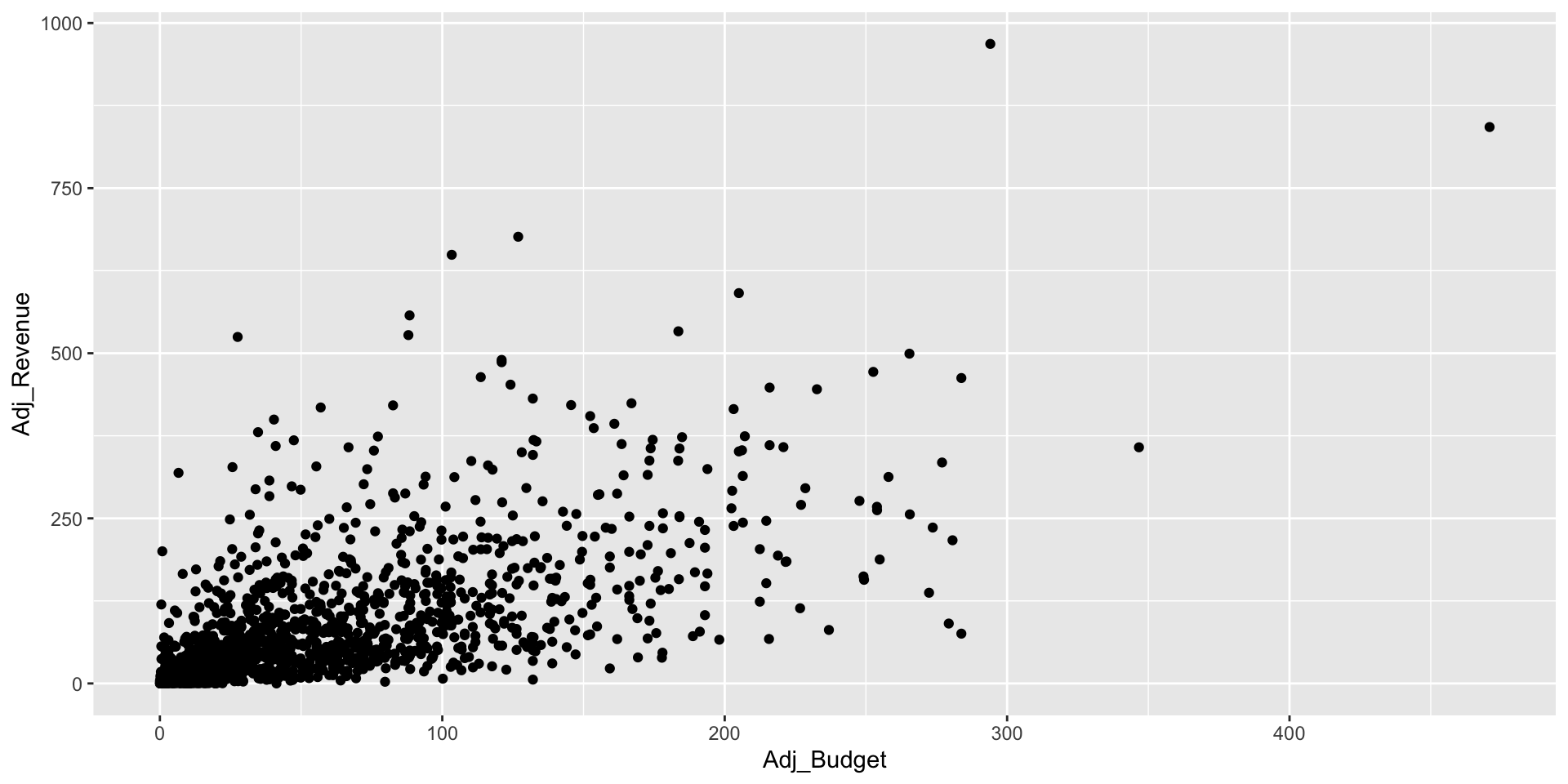

Let’s get into some data

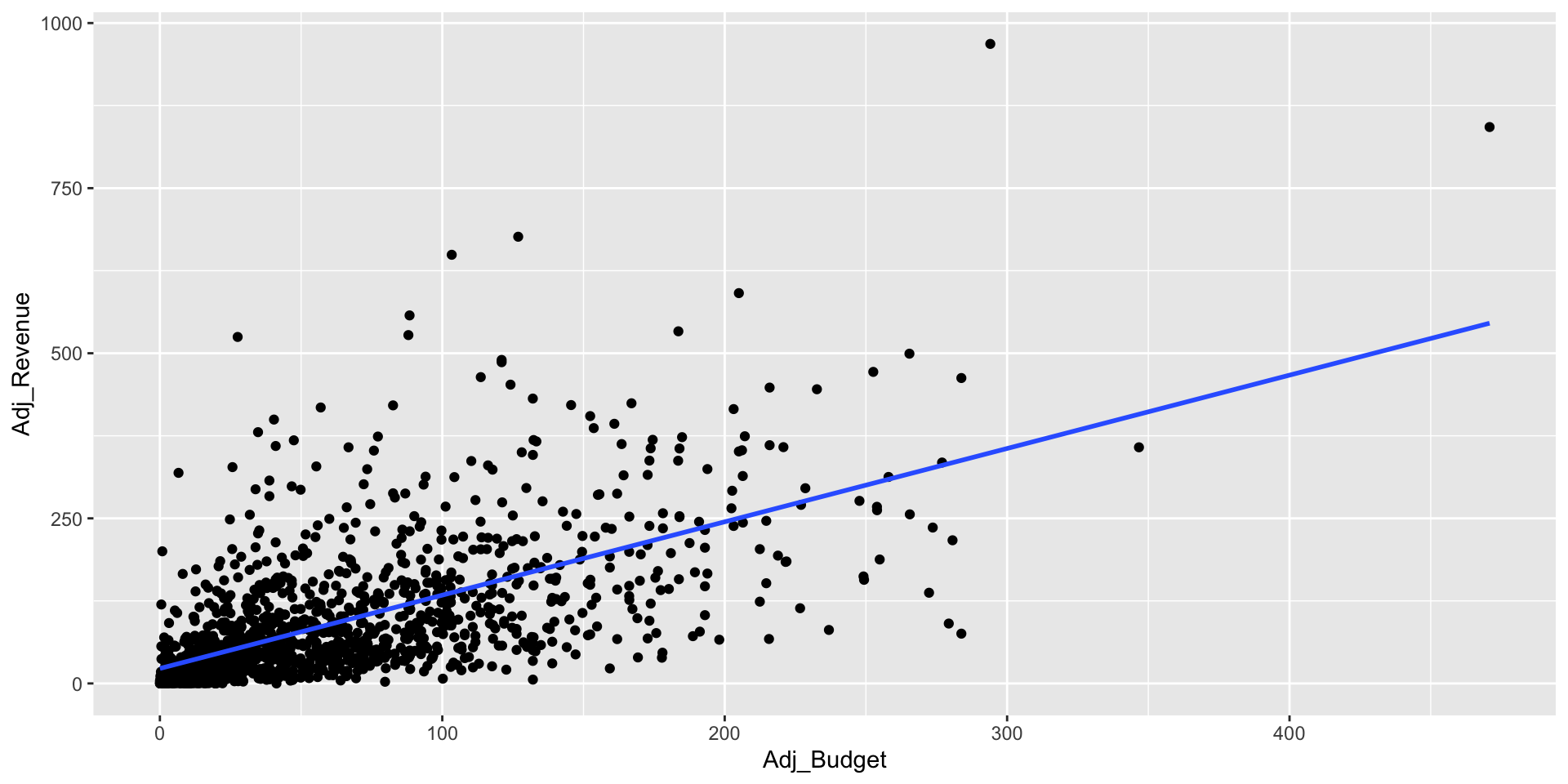

- Example: Movie data Set (

movie_1990_data.csv) - We will create a model that explains and predicts the movie revenue in terms of the budget.

- There are 1,368 different movies in the data, with 22 different attributes.

- This means that the data contains 1,368 lines and 22 columns.

- We are interested in two attributes, the movie budget, and movie revenue.

- Movie budget is in the predictor variable -

Adj_Budget. - Movie revenue is in the response variable -

Adj_Revenue. - The units in this case are important (both are in millions of dollars).

- Let’s visualize the relation between these two variables.

- First we load the library

tidyverse, then we use theggplotfunction to make plot betweenAdj_BudgetandAdj_Revenue

We encode the model below in R.

\[ \texttt{Adj_Revenue} = \beta_0 + \beta_1\cdot\texttt{Adj_Budget} + e \]

# The model

# Revenue = intercept + slope*Budget + e

lm1 <- lm(Adj_Revenue ~ Adj_Budget, data = movie_1990_data)

summary(lm1)

Call:

lm(formula = Adj_Revenue ~ Adj_Budget, data = movie_1990_data)

Residuals:

Min 1Q Median 3Q Max

-262.40 -38.01 -16.39 19.24 619.23

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 22.66095 3.15001 7.194 1.03e-12 ***

Adj_Budget 1.11043 0.03738 29.709 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 79.78 on 1366 degrees of freedom

Multiple R-squared: 0.3925, Adjusted R-squared: 0.3921

F-statistic: 882.6 on 1 and 1366 DF, p-value: < 2.2e-16Let’s interpret the output

- From the coefficients, \(\widehat\beta_0 = 22.7\), \(\widehat\beta_1 = 1.11\) we have the updated model: \[ \widehat{\texttt{Adj_Revenue}} = 22.7 + 1.11\cdot\texttt{Adj_Budget} \]

- When there’s a hat, it means that the values were generated from the data.

- \(e\) (noise) vanishes because we eliminated the unknown factors and concentrated the effect on what we observe.

- Now we have the residuals, that is the distance between the points in the data and the regression model.

- The question now is: how can we interpret this result?

Explanation

- Intercept: By setting the movie budget to zero, we have that the average revenue is equal to $22.7 million dollars.

- Slope: For one unit change in the movie budget, that is, millions, there will be an increase of $1.11 million dollars in the movie’s revenue.

Let’s visualize this model.

Statistical significance of the model

- Are these coefficients statistically significant?

- Can we extrapolate the results to the larger population?

- We can answer these questions by looking at the confidence interval (CI).

Statistical significance of the model

From the confidence interval we have that:

- The value of the intercept is statistically different from zero since zero is not between the lower and upper values of the interval .

- The value of the slope is statistically different from zero since zero is not between the lower and upper values of the interval .

- With 95% confidence, the value of the intercept at the population level is between 16.5 and 28.8 million dollars .

- With 95% confidence, the value of the slope at the population level is between 1.04 and 28.8 million dollars .

Predictions

- Suppose we want to predict the revenue of a movie , knowing that the revenue was $25 million.

- We can use our estimated model to make the prediction.

- Input the value into the adjusted budget, resulting in: \[ \widehat{\texttt{Adj_Revenue}} = 22.7 + 1.11\cdot 25 = 50.45 \]

- The average predicted revenue of a $25 million dollar budget movie is $50 million dollars.

- We can also do this using the

predictfunction in R

Predictions

- How good are these predictions?

- We can use the residual standard error (RSE), which is a result of the

summaryfunction. - \(\texttt{Residual standard error: 79.78}\),

- These mean that our predictions will be off by approximately 79.78.

- With 95% confidence, the prediction of the revenue will be 50.42 plus and minus \(2\times 79.78 = 159.56\).

- Quite a big variation.

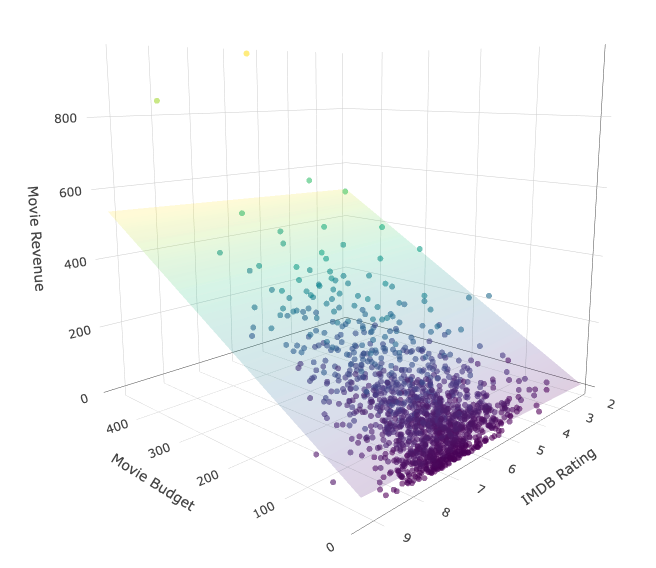

Adding more variables

- We can add more variables in our model.

- We will add the variable

imdbRatingwhich encodes the different IMDB ratings in the data (1-10). - The resulting model now is \[ \texttt{Adj_Revenue} = \beta_0 + \beta_1\cdot\texttt{Adj_Budget} + \beta_2\cdot\texttt{imdbRating} + e \]

- You can observe that we have an extra slope in the equation.

- This will have an impact in how we interpret the model.

- Next we encode this model in R

Adding more variables

# The model

# Revenue = intercept + slope*Budget + slope*Rating + e

lm2 <- lm(Adj_Revenue ~ Adj_Budget + imdbRating, data = movie_1990_data)

summary(lm2)

Call:

lm(formula = Adj_Revenue ~ Adj_Budget + imdbRating, data = movie_1990_data)

Residuals:

Min 1Q Median 3Q Max

-256.79 -41.25 -14.97 26.55 598.53

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -136.50696 14.64962 -9.318 <2e-16 ***

Adj_Budget 1.09103 0.03585 30.433 <2e-16 ***

imdbRating 24.09935 2.17050 11.103 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 76.43 on 1365 degrees of freedom

Multiple R-squared: 0.4428, Adjusted R-squared: 0.442

F-statistic: 542.5 on 2 and 1365 DF, p-value: < 2.2e-16Visualizing the model

Explanation

- Let’s interpret the model:

\[ \texttt{Adj_Revenue} = -136.507 + 1.091 \cdot\texttt{Adj_Budget} + 24.099\cdot\texttt{imdbRating} \]

- Intercept: By setting the movie budget and the rating to zero, we have that the average revenue is equal to $-137 million dollars.

- Slope Budget: For movies with the same fixed rating, for one unit change in the movie budget, there will be an increase of $1.091 million dollars in the movie’s revenue.

- Slope Rating: For movies with the same fixed budget, for one unit change in the movie rating, there will be an increase of $24.1 million dollars in the movie’s revenue.

Statistical significance of the model

- Let’s analyse the confidence interval

2.5 % 97.5 %

(Intercept) -165.245169 -107.768758

Adj_Budget 1.020706 1.161364

imdbRating 19.841475 28.357234- All coefficients are statistically significant.

What about the predictions?

- We can observe from the summary that the

residual standard errorwhen down to \(\texttt{76.43}\). - Which will result in more accurate predictions.

- Suppose we have a movie 25 million dollar budget and the movie has a IMDb rating of 5.4 what is the prediction for this movie?

- What about the 95% prediction interval for this prediction?

# We use the confint() function to get the confidence interval

predict(lm2, list(Adj_Budget = 25, imdbRating = 5.4)) 1

20.90542 - What about the 95% prediction interval for this prediction?

- upper bound: \(20.90542 + 2\times 76.43 = 173.7654\)

- lower bound: \(20.90542 - 2\times 76.43 = -131.9546\)

What’s next?

- We’ll include categorical variables.

- Interactions between categorical and numerical variables.