Data Science for Business Applications

Polynomial models

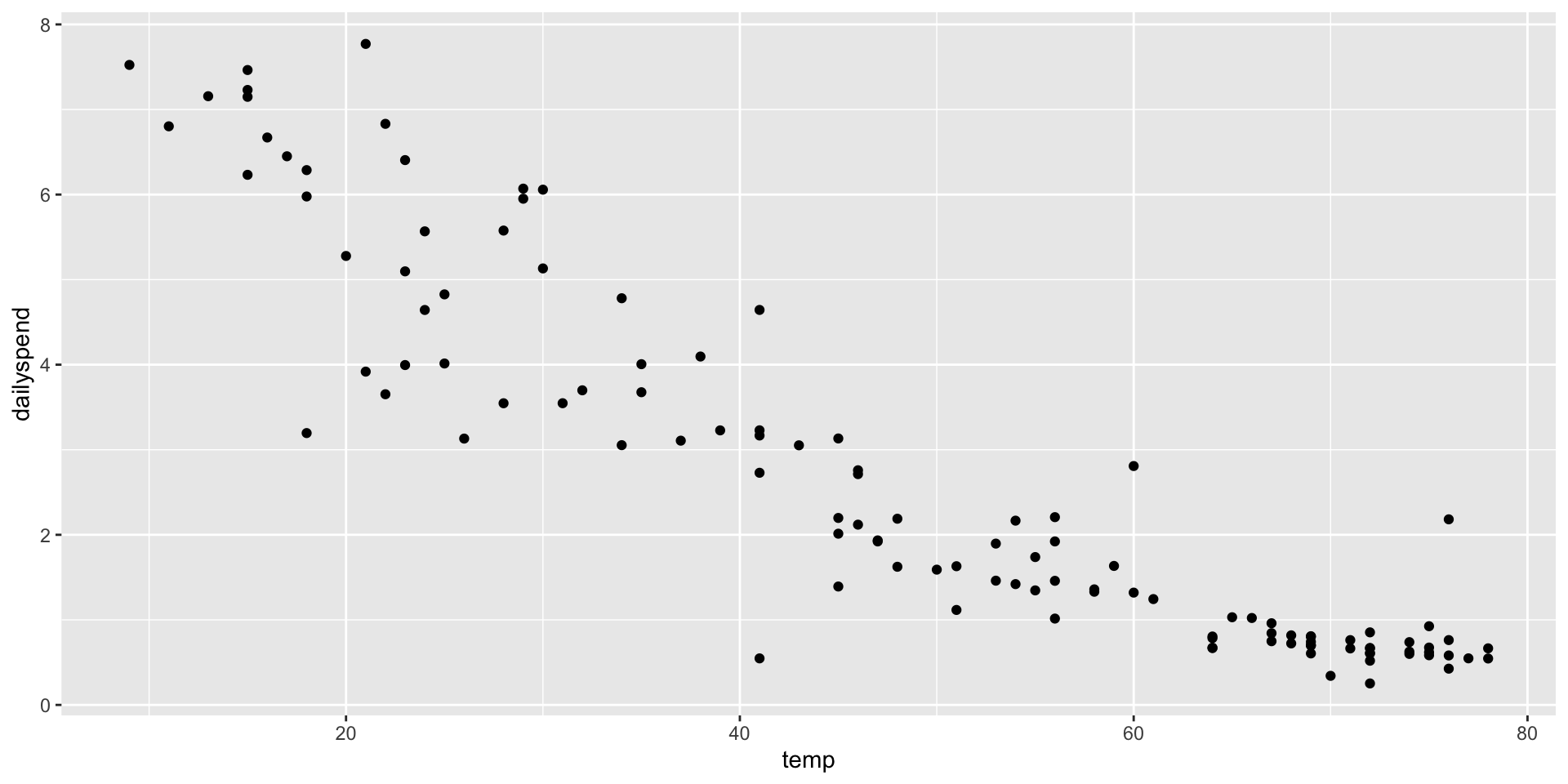

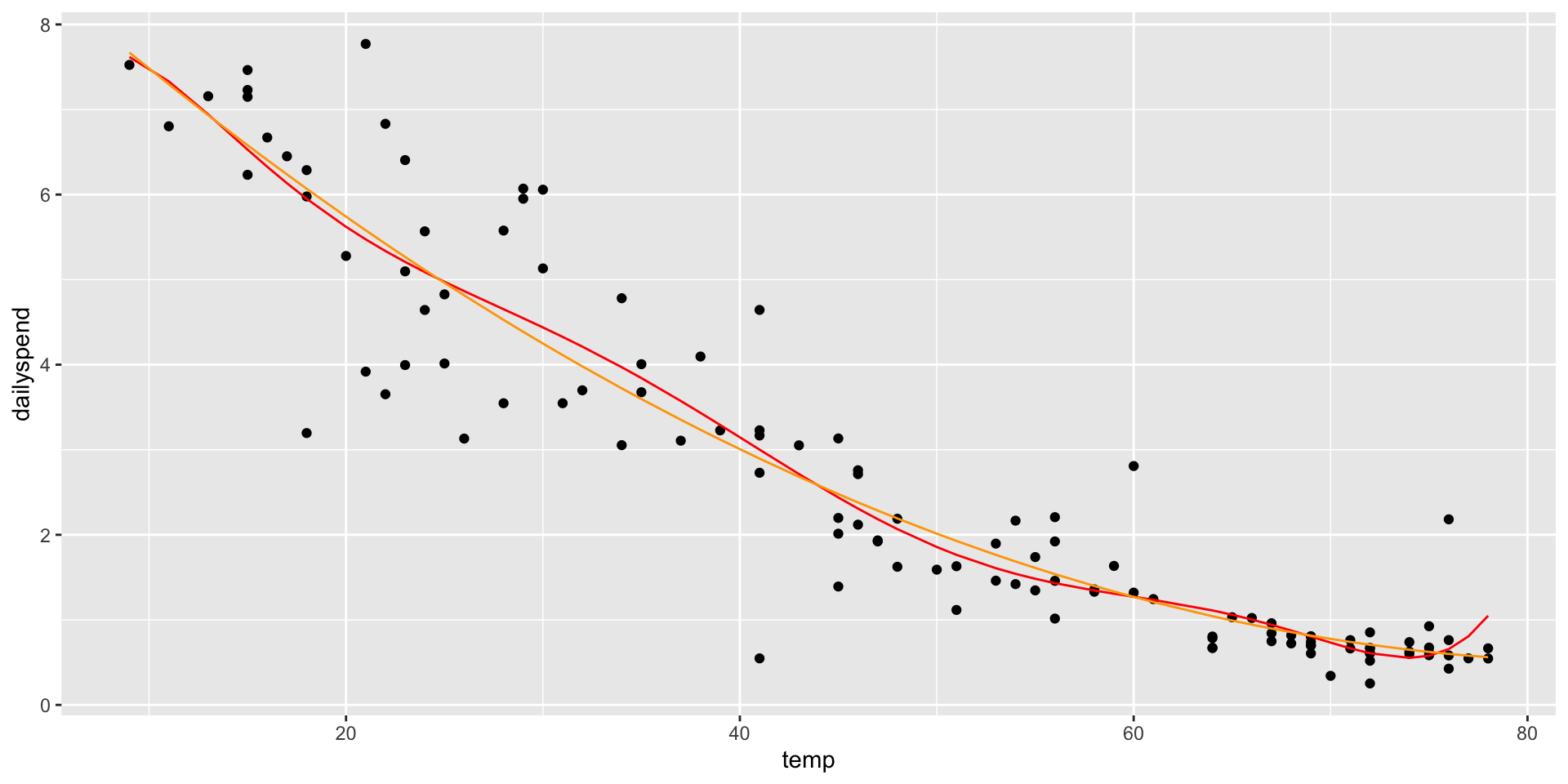

The data set utilities contains information on the utility bills for a house in Minnesota. We’ll focus on two variables:

dailyspendis the average amount of money spent on utilities (e.g. heating) for each day during the monthtempis the average temperature outside for that month

Polynomial models

What problems do you see here?

Polynomial models

Call:

lm(formula = dailyspend ~ temp, data = utilities)

Residuals:

Min 1Q Median 3Q Max

-2.84674 -0.50361 -0.02397 0.51540 2.44843

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.347617 0.206446 35.59 <2e-16 ***

temp -0.096432 0.003911 -24.66 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.8663 on 115 degrees of freedom

Multiple R-squared: 0.841, Adjusted R-squared: 0.8396

F-statistic: 608.1 on 1 and 115 DF, p-value: < 2.2e-16- Let’s interpret this relation

- For one unit increase in temperature (Fahrenheit), there will be a 10-cent decrease in spending

Polynomial models

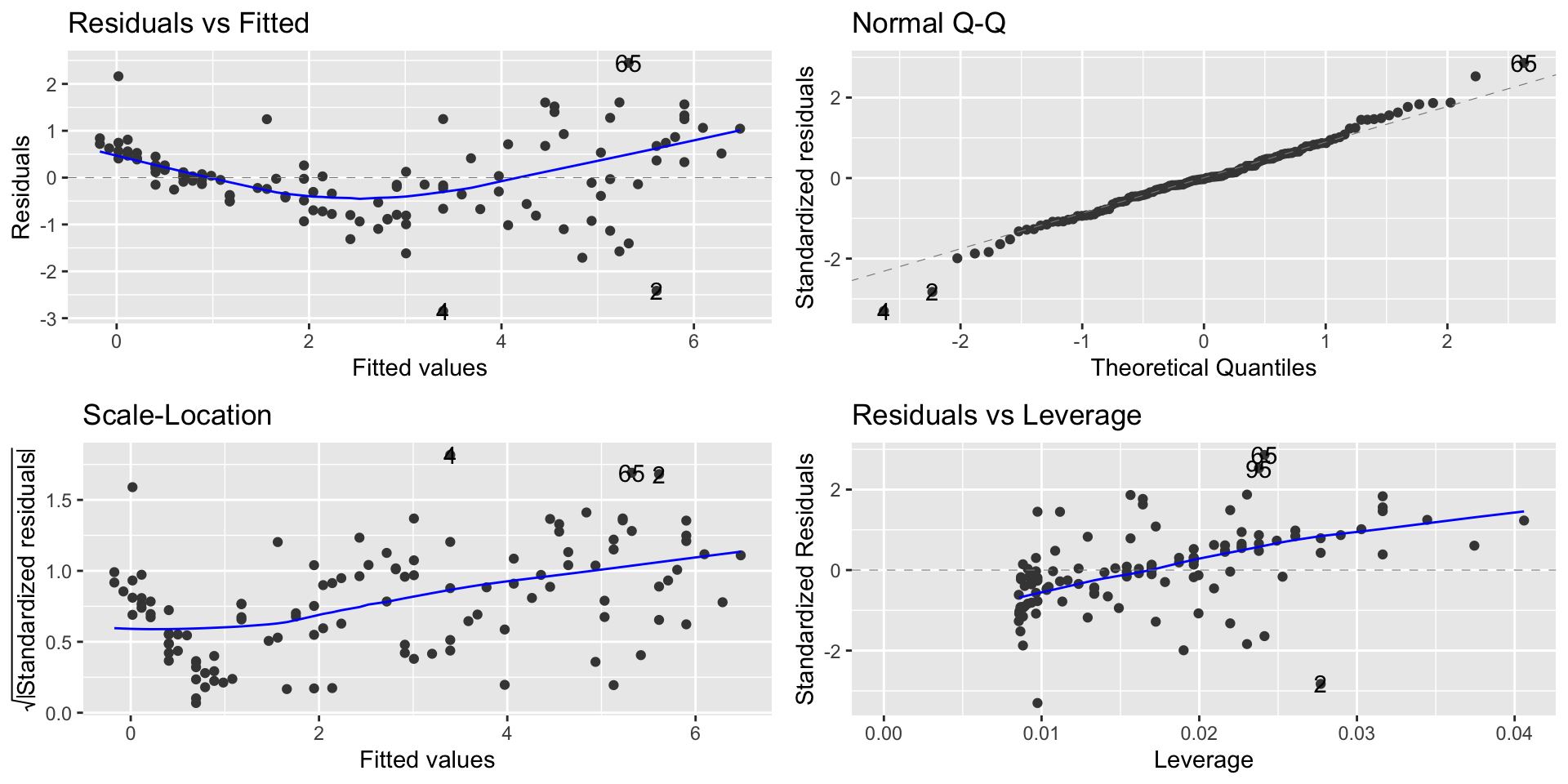

- Linearity and homoscedasticity are violated

Polynomial models

- We’ll use polynomial regression to fix problems

- If a polynomial curve (e.g., quadratic, cubic, etc) would be a better fit for the data than a line, we can fit a curve to the data.

- The way we do this is by adding \(X^2\) to the model as a second predictor variable.

- This can “fix” the linearity problem because now \(Y\) is a linear function of \(X\) and \(X^2\), resulting in: \[ Y = \beta_0 + \beta_1\cdot X + \beta\cdot X^2 + e \]

Polynomial models

- We add the term

I(temp^2)in the regression equation:

Call:

lm(formula = dailyspend ~ temp + I(temp^2), data = utilities)

Residuals:

Min 1Q Median 3Q Max

-2.87250 -0.28048 -0.03929 0.26391 2.19117

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 9.4722885 0.3907892 24.239 < 2e-16 ***

temp -0.2115553 0.0191046 -11.074 < 2e-16 ***

I(temp^2) 0.0012476 0.0002037 6.124 1.33e-08 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.7547 on 114 degrees of freedom

Multiple R-squared: 0.8803, Adjusted R-squared: 0.8782

F-statistic: 419.3 on 2 and 114 DF, p-value: < 2.2e-16- We have that the new term is evaluated as an extra variable.

Polynomial models

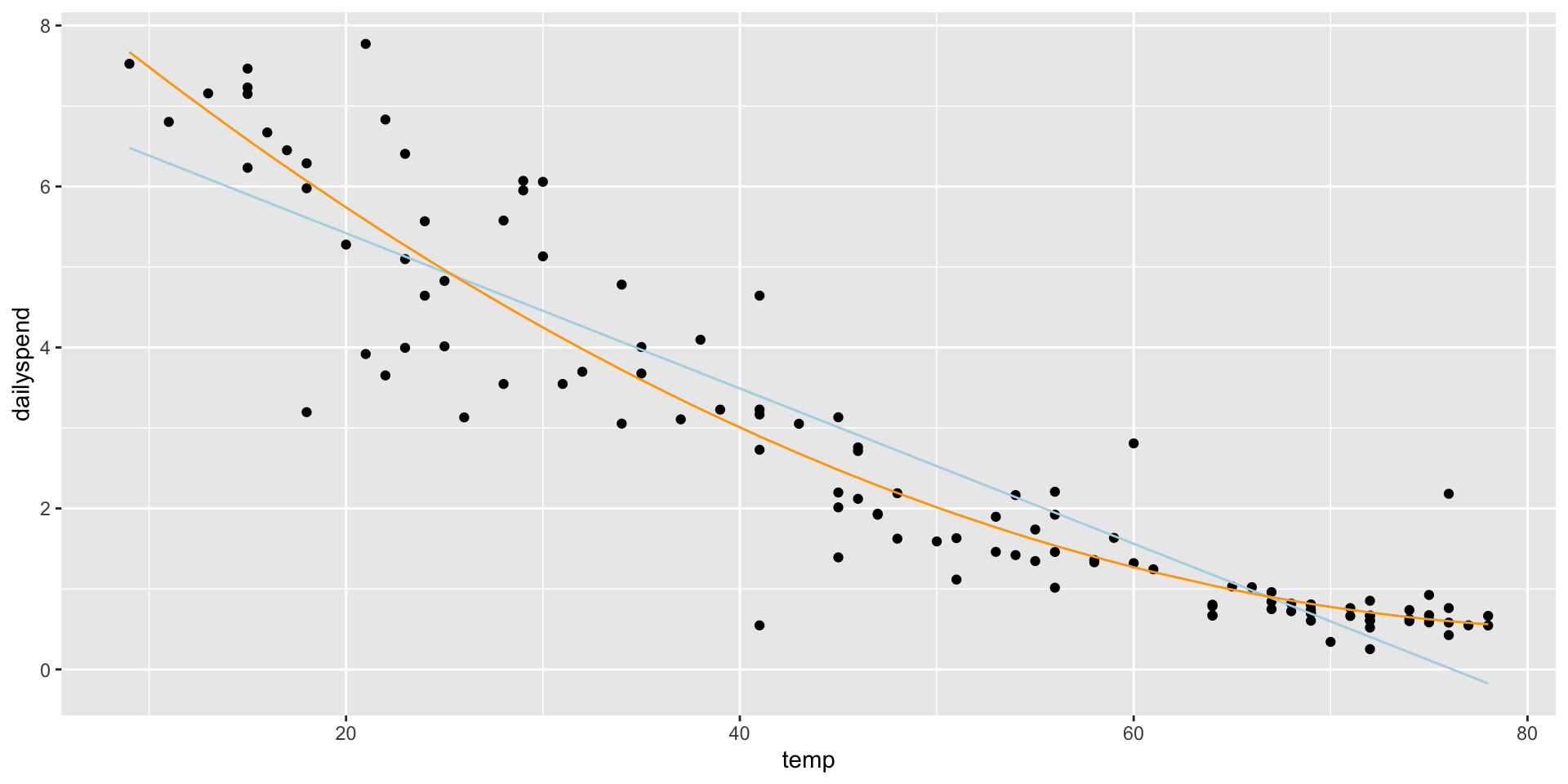

Writing out the equation: \[ \widehat{\texttt{dailyspend}} = 9.4723 −0.2116\cdot \texttt{temp} + 0.0012\cdot \texttt{temp}^2 \] The effect of the extra variable is statistically significant:

2.5 % 97.5 %

(Intercept) 8.6981381712 10.246438869

temp -0.2494014032 -0.173709160

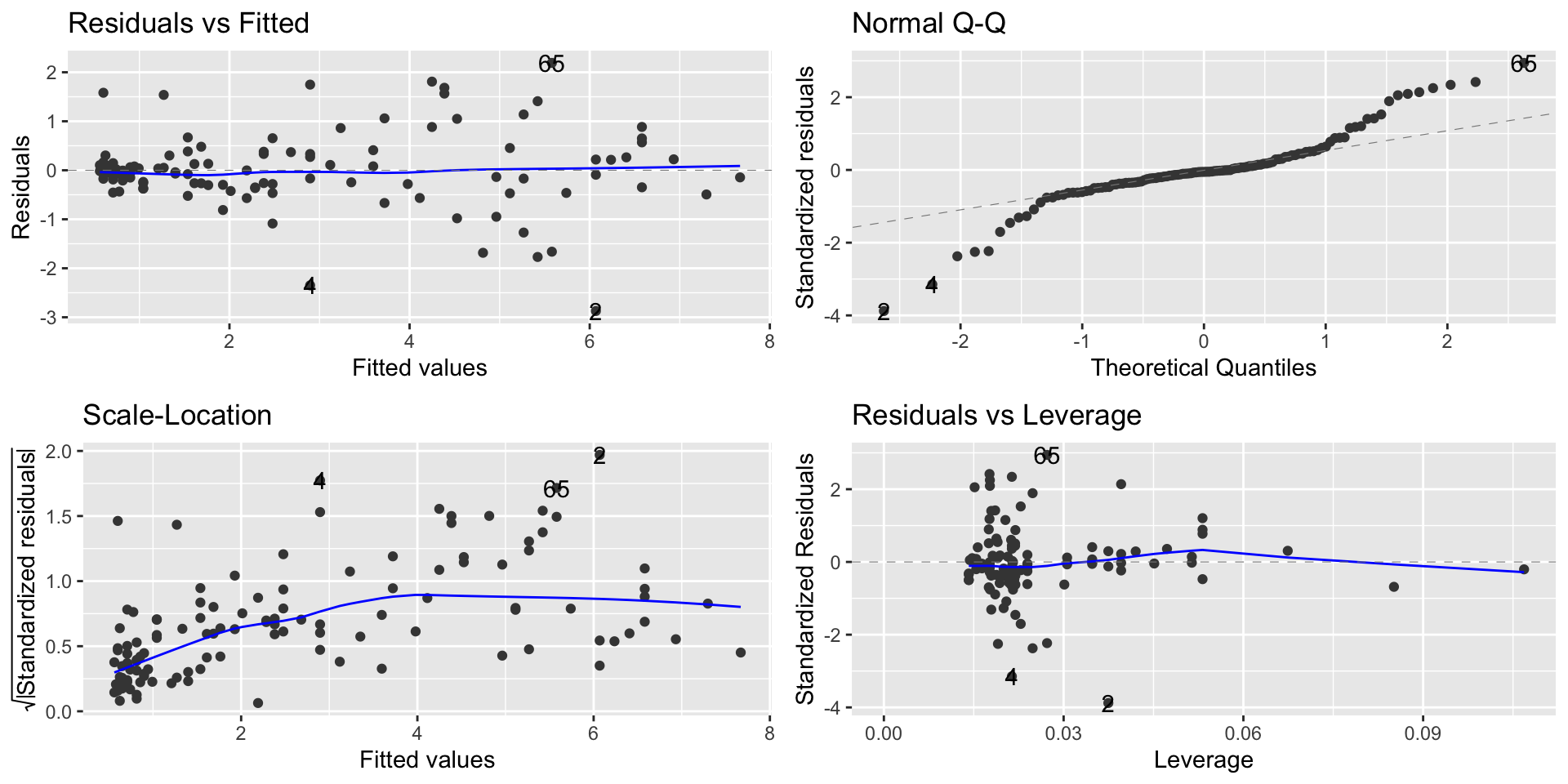

I(temp^2) 0.0008440041 0.001651114- The residual standard error of the polynomial model is \(\texttt{0.75}\).

- The residual standard error of the linear model is \(\texttt{0.87}\).

Polynomial models

Adding an \(X^2\) term fits a parabola to the data (orange line)

Polynomial models

It solves the linearity problem

Polynomial models

- What about a higher-order polynomial?

- We could fit a cubic curve by adding an \(X^3\) term

- Making the polynomial higher order will decrease the

RSE - Why not go nuts and fit a 7th degree polynomial?

| Degree | name | RSE |

|---|---|---|

| 1 | linear | 0.866 |

| 2 | quadratic | 0.754 |

| 3 | cubic | 0.755 |

| 4 | quartic | 0.755 |

| 5 | quintic | 0.758 |

| 6 | 0.761 | |

| 7 | 0.761 |

Polynomial models

- Too high a degree creates dangers with extrapolation

Building polynomial models

Start simple: only add higher-degree terms to the extent it gives you a substantial decrease in the RSE, or satisfies an assumption hold that wasn’t satisfied before

- You must include lower-order terms: e.g., if you add \(X^3\), you must also include \(X\) and \(X^2\)

- Be careful about overfitting when adding higher-order terms!

- Be particularly careful about extrapolating beyond the range of the data!

- Mind-bender: We can think about an \(X^2\) term as an interaction of \(X\) with itself: in a parabola, the slope depends on the value of \(X\)

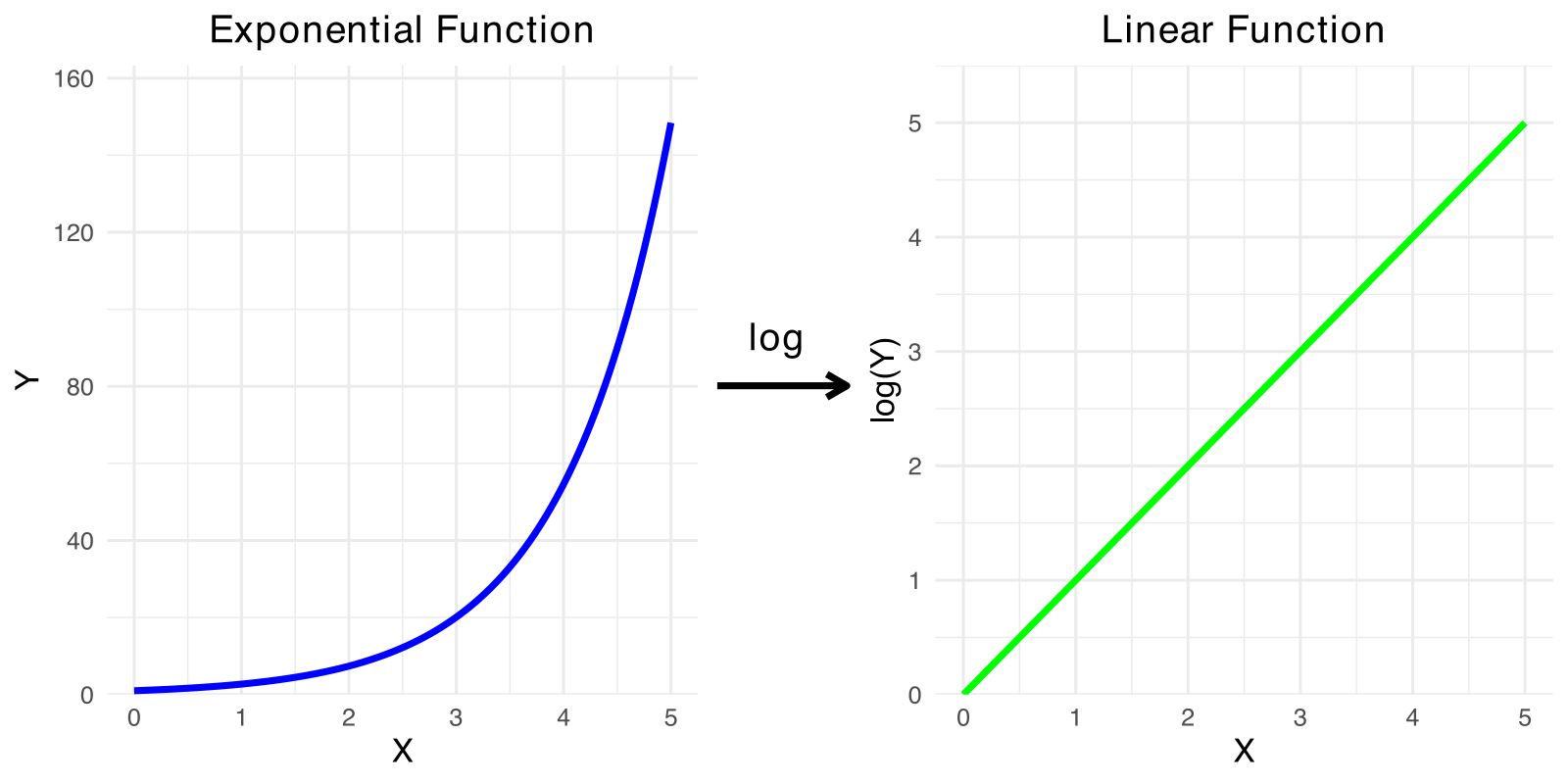

The log transformation

- We saw that we can use transformations to fix problems

- Sometimes, a violation of regression assumptions can be fixed by transforming one or the other of the variables (or both).

- When we transform a variable, we have to also transform our interpretation of the equation.

The log transformation

The log transformation is frequently useful in regression, because many nonlinear relationships are naturally exponential.

- \(\log_b x=y\) when \(b^y=x\)

- For example, \(\log_{10} 1000 = 3\), \(\log_{10}100 = 2\), and \(\log_{10}10 = 1\)

The log transformation

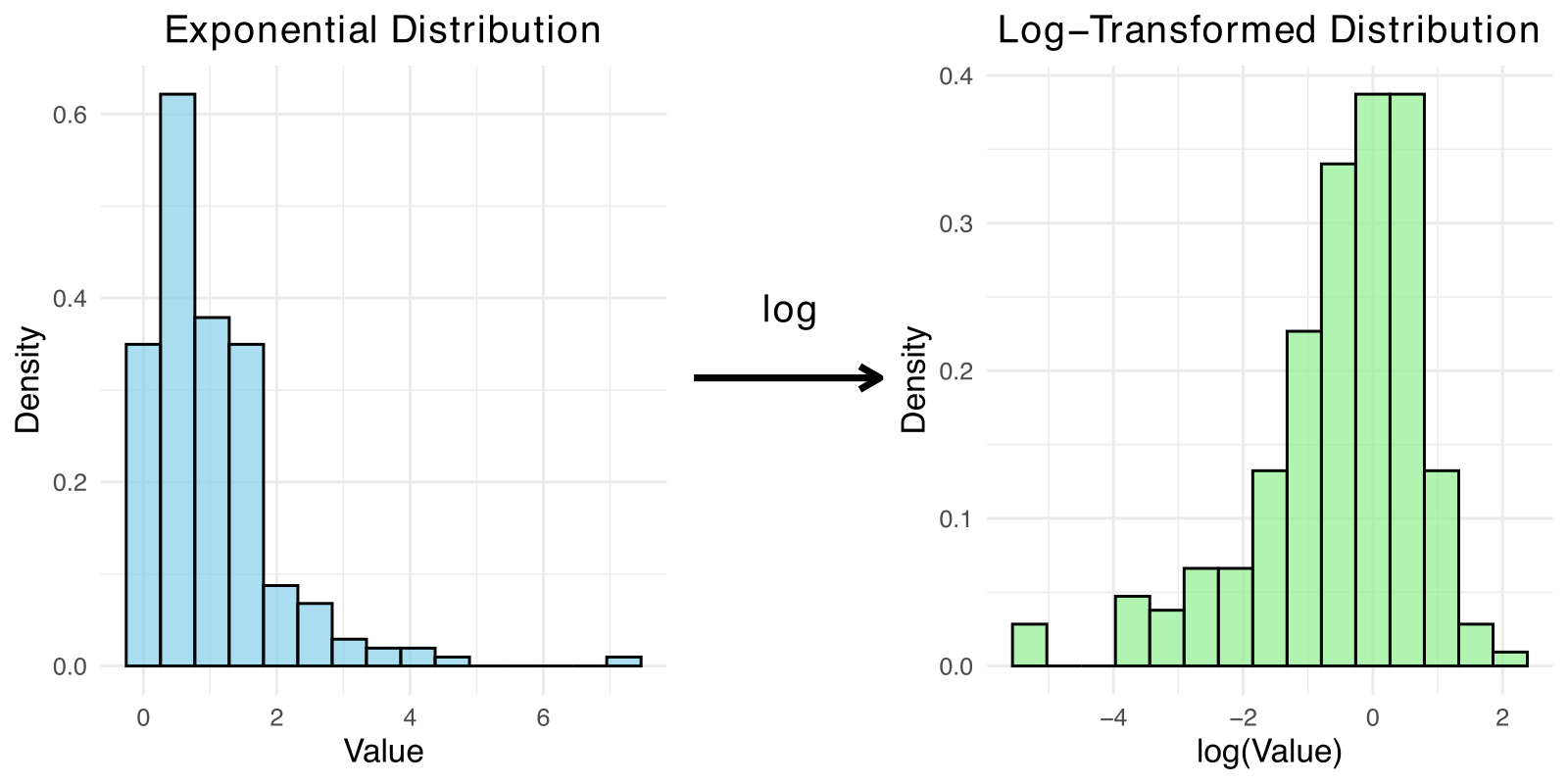

- Anytime you need to ”squash” one of the variables (logs make huge numbers not so big!)

- Skewed data is also a good candidate for log

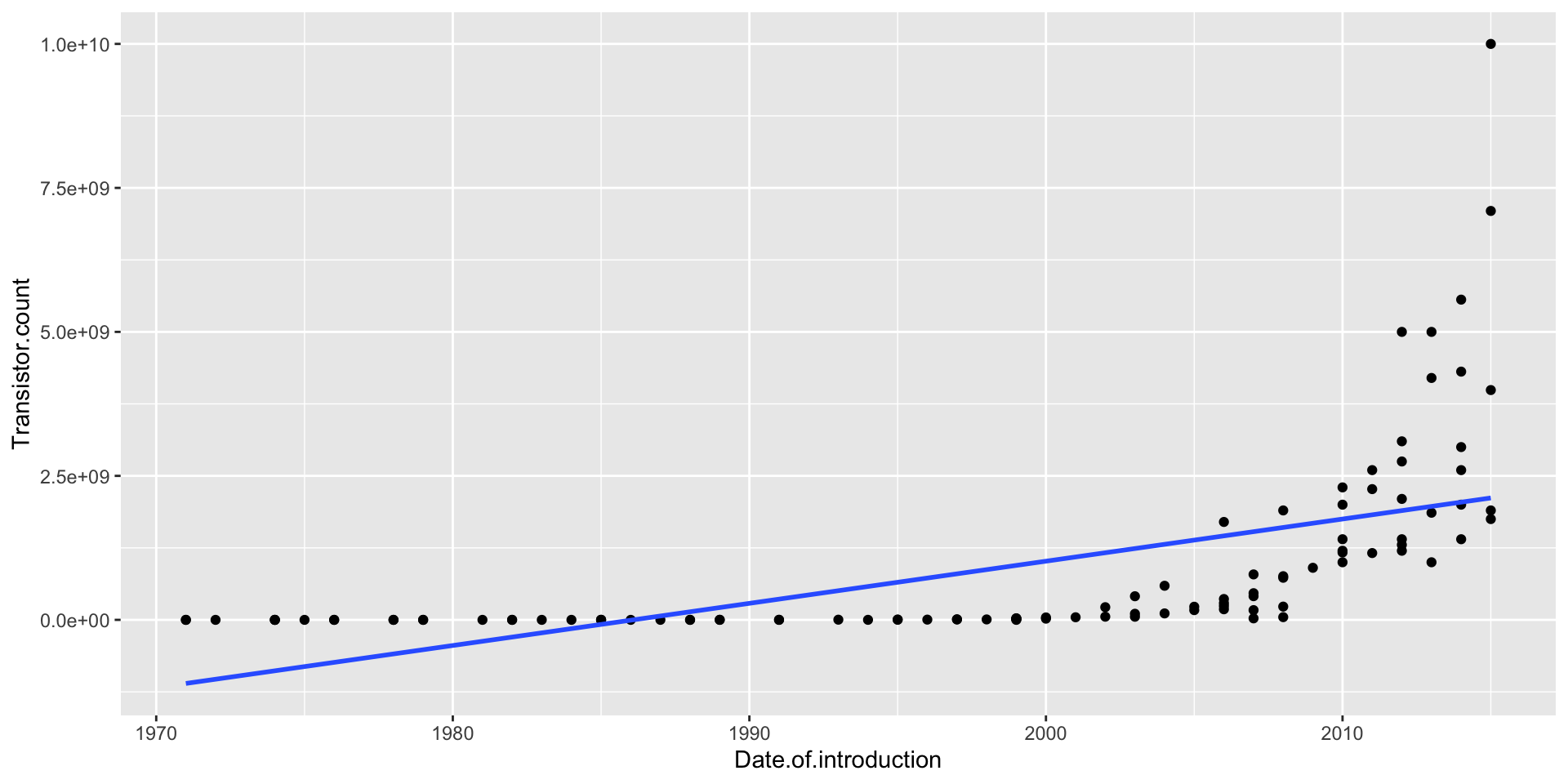

Moore’s Law

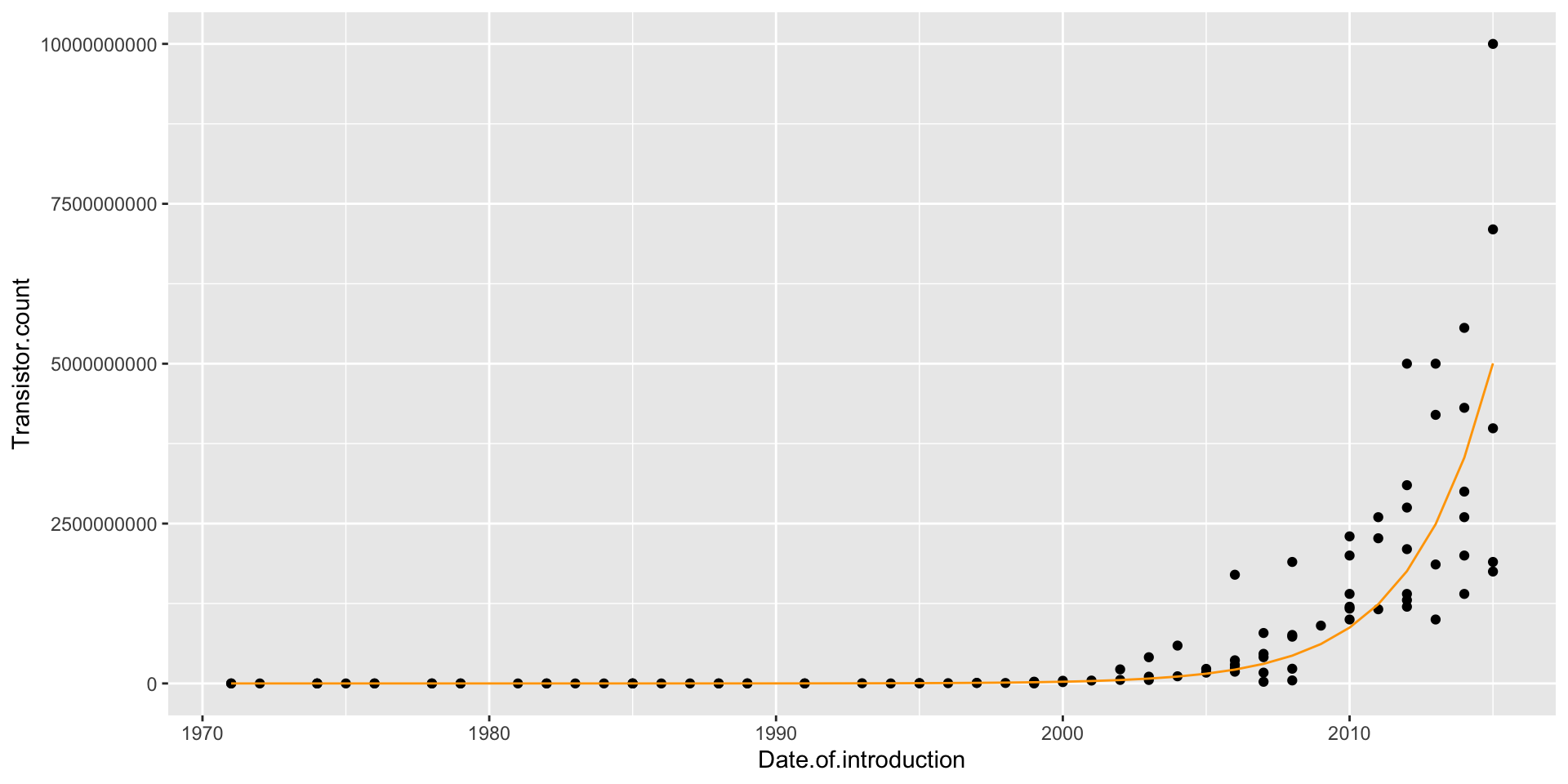

Moore’s Law was a prediction made by Gordon Moore in 1965 (!) that the number of transistors on computer chips would double every 2 years

This implies exponential growth, so a linear model won’t fit well (and neither will any polynomial)

Moore’s Law

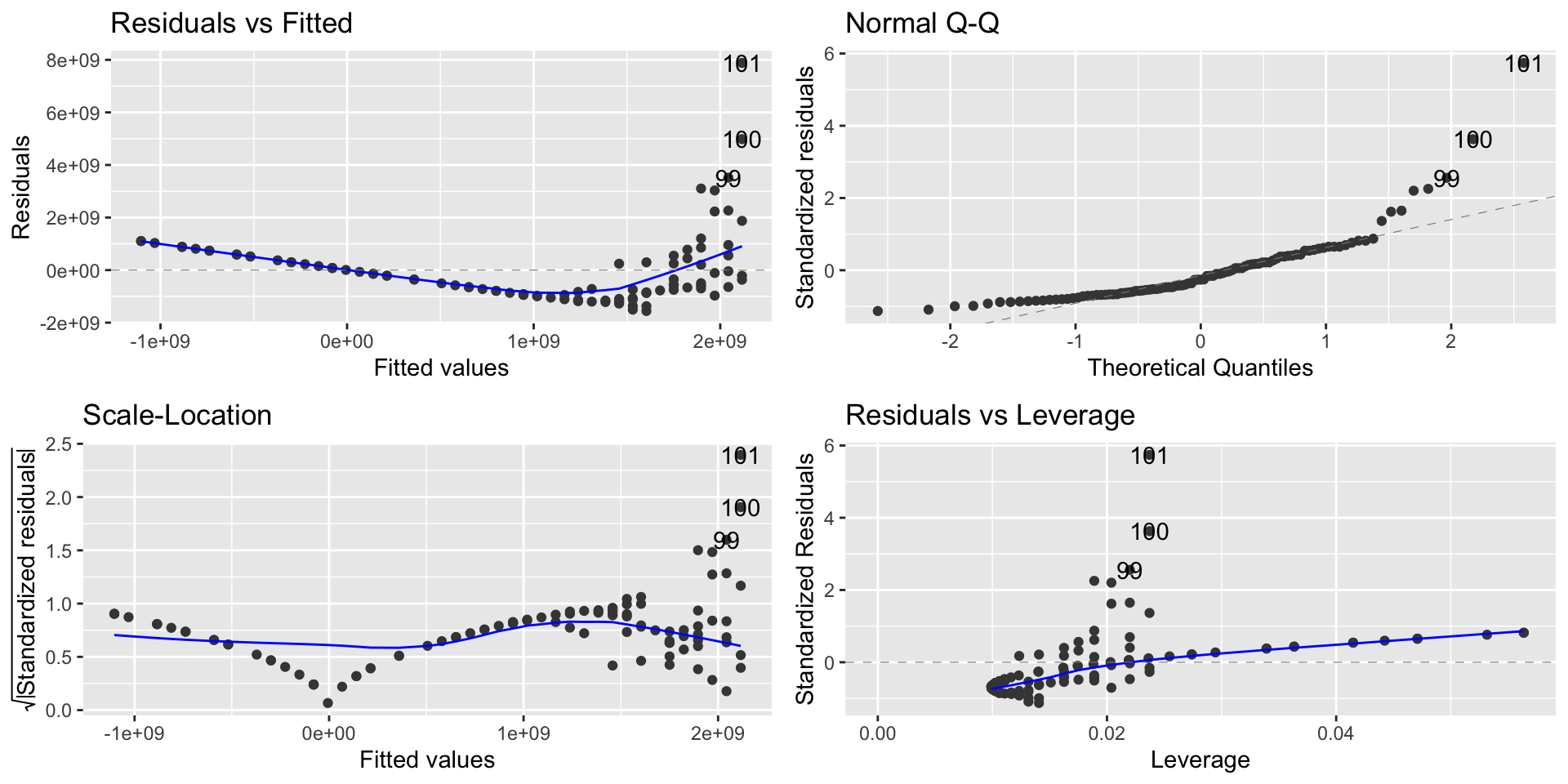

- A linear model is a spectacular fail

Modeling exponential growth

If \(Y = ae^{bX}\), then

\[\log(Y) = \log(a)+ bX\]

In other words, \(\log(Y)\) is a linear function of \(X\) when \(Y\) is an exponential function of \(X\)

So if we think \(Y\) is an exponential function of \(X\), predict \(\log(Y)\) as a linear function of \(X\)

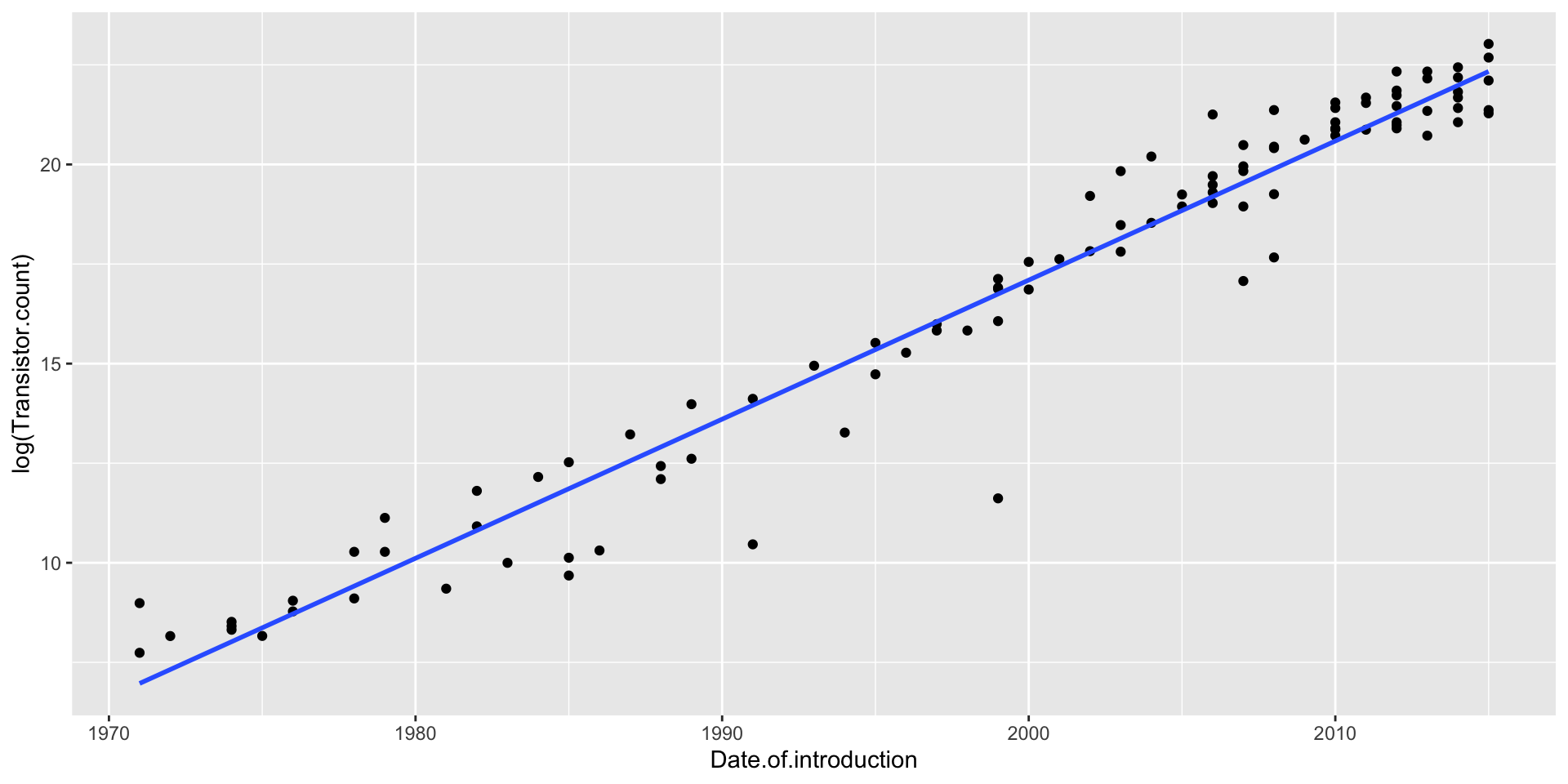

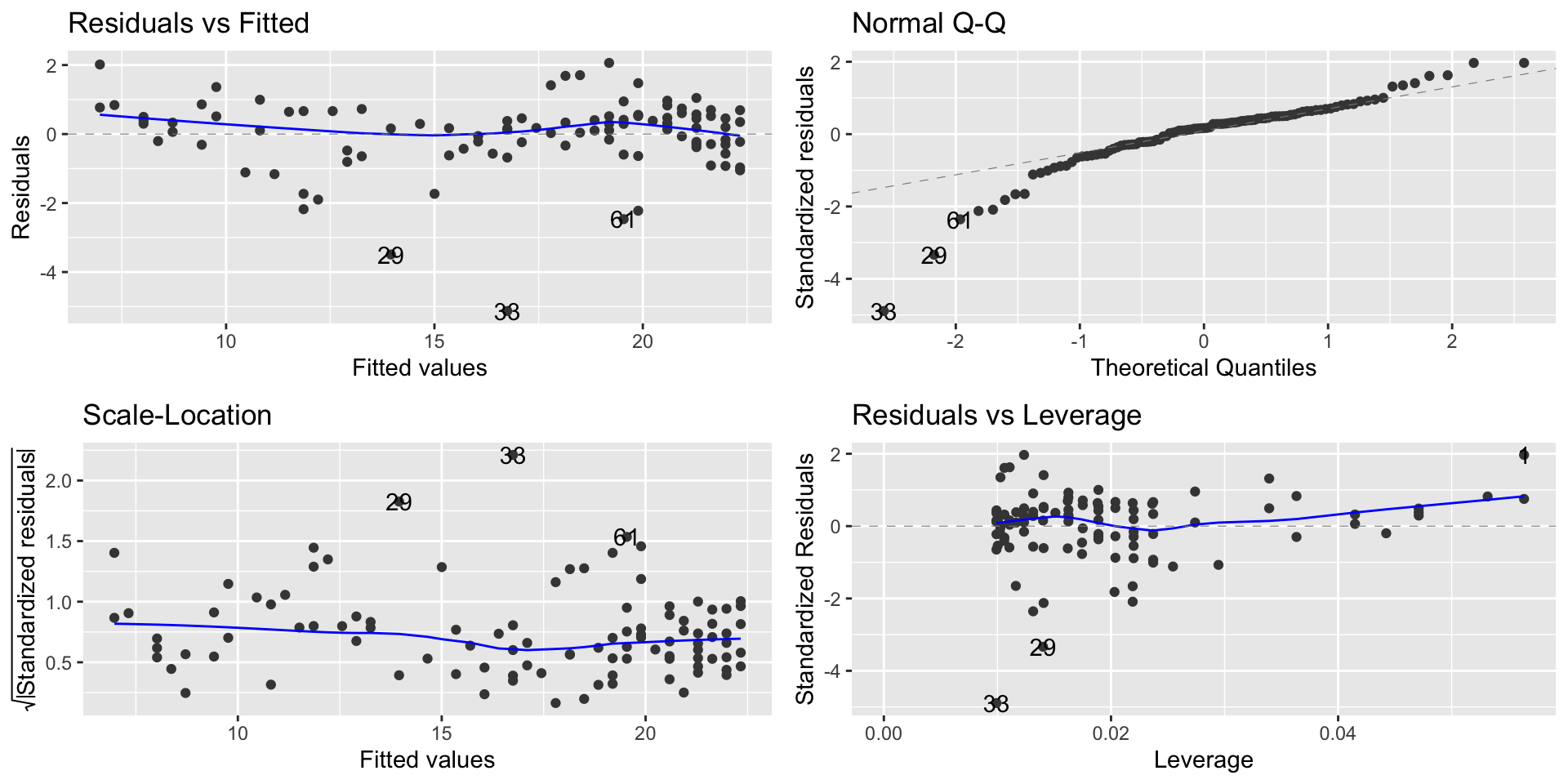

Modeling exponential growth

- Transistors does NOT have a linear relationship with year

- \(\log(\texttt{Transistors})\) does have a linear relationship with year

Log-linear Model

Let’s run the regression model

options(scipen = 999)

lm_moore = lm(log(Transistor.count) ~ Date.of.introduction, data = moores)

summary(lm_moore)

Call:

lm(formula = log(Transistor.count) ~ Date.of.introduction, data = moores)

Residuals:

Min 1Q Median 3Q Max

-5.1299 -0.3338 0.1767 0.5230 2.0626

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -681.212056 15.958165 -42.69 <0.0000000000000002 ***

Date.of.introduction 0.349154 0.007981 43.75 <0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.054 on 99 degrees of freedom

Multiple R-squared: 0.9508, Adjusted R-squared: 0.9503

F-statistic: 1914 on 1 and 99 DF, p-value: < 0.00000000000000022Modeling exponential growth

Interpretation of the model

Our model is \[\widehat{\log(\texttt{Transistors})} = −681.21 + 0.35 \cdot \texttt{Year}\]

Two interpretations of the slope coefficient:

Every year, the predicted log of transistors goes up by 0.35

More useful: Every year, the predicted number of transistors goes up by 35%

A constant percentage increase every year is exponential growth!

Interpretation of the model

Making predictions using the log-linear model

When making predictions, we have to remember that our equation gives us predictions for \(\log(\texttt{Transistors})\), not Transistors!

Example: To make a prediction for the number of transistors in 2022: \[ \log(\texttt{Transistors}) = −681.21 + 0.35(2022) = 26.49 \] But our prediction is not 26.49:

\(e^{\log(\texttt{Transistors})} = e^{26.49} = 319,492,616,196\)

Interpretation of the model

Interpretation of the model

| Model | Equation | Interpretation |

|---|---|---|

| Linear | \(\widehat{Y} = \widehat{\beta}_0 + \widehat{\beta}_1 X\) | 1 unit increase in \(X\) implies \(\widehat{\beta}_1\) unit increase in \(\widehat{Y}\) |

| Log-linear | \(\log(\widehat{Y}) = \widehat{\beta}_0 + \widehat{\beta}_1 X\) | 1 unit increase in \(X\) implies ≈ \(100 \cdot \widehat{\beta}_1 \%\) increase in \(\widehat{Y}\) |

| Linear-log | \(\widehat{Y} = \widehat{\beta}_0 + \widehat{\beta}_1 \log(X)\) | 1% increase in \(X\) implies ≈ \(0.01 \cdot \widehat{\beta}_1\) unit increase in \(\widehat{Y}\) |

| Log-log | \(\log(\widehat{Y}) = \widehat{\beta}_0 + \widehat{\beta}_1 \log(X)\) | 1% increase in \(X\) implies ≈ \(\widehat{\beta}_1 \%\) increase in \(\widehat{Y}\) |

Conclusion

When is the log transformation useful?

You can transform \(X \rightarrow \log(X)\), \(Y \rightarrow \log(Y)\), or both

Anytime you need to ”squash” one of the variables (logs make huge numbers not so big!), try transforming it with a log

In this case, Transistors is skewed right so it is a good candidate for log

You may need to do a little bit of trial and error to see what works best

Other transformations are possible!