Data Science for Business Applications

Basic time series concepts

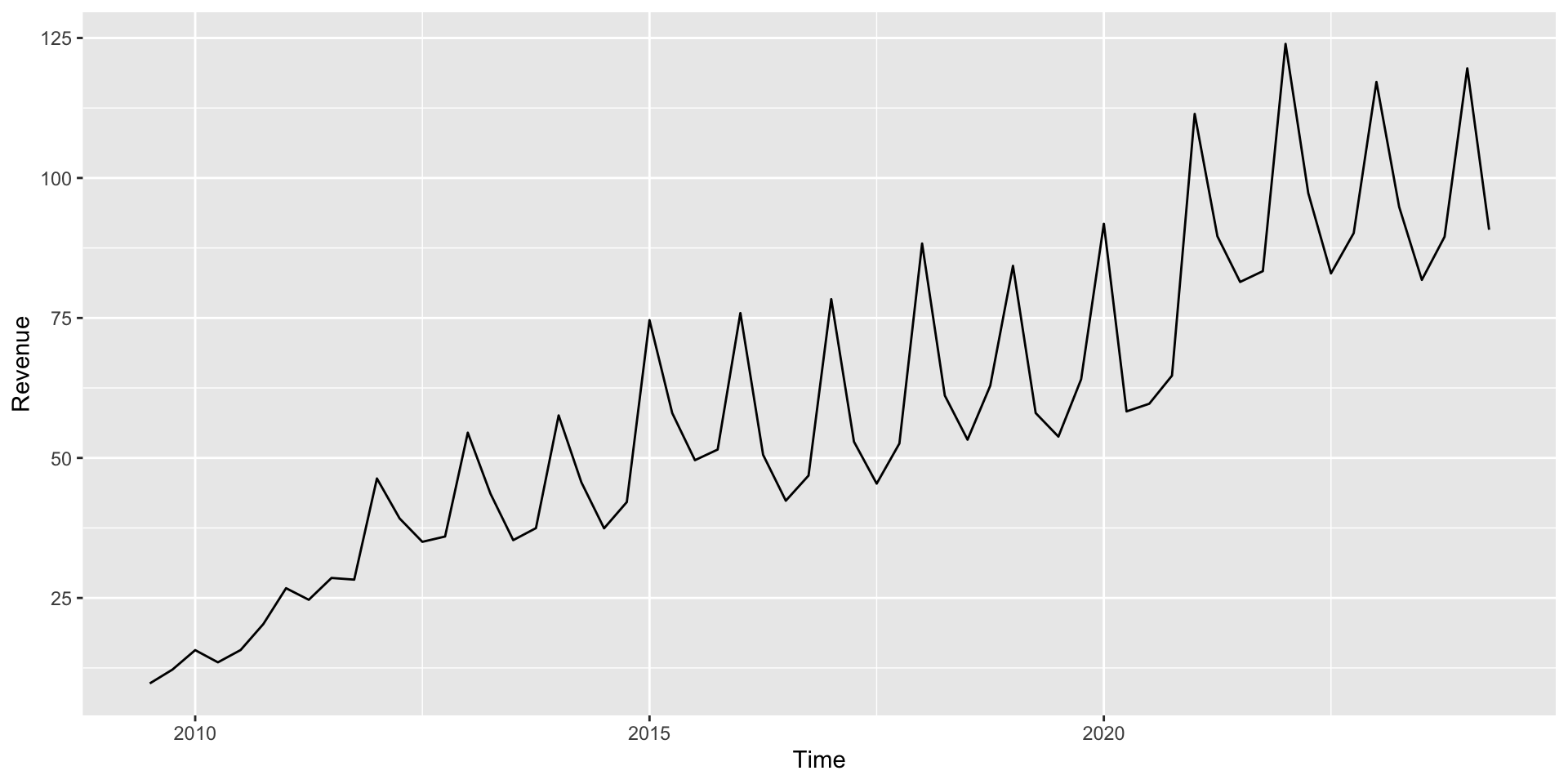

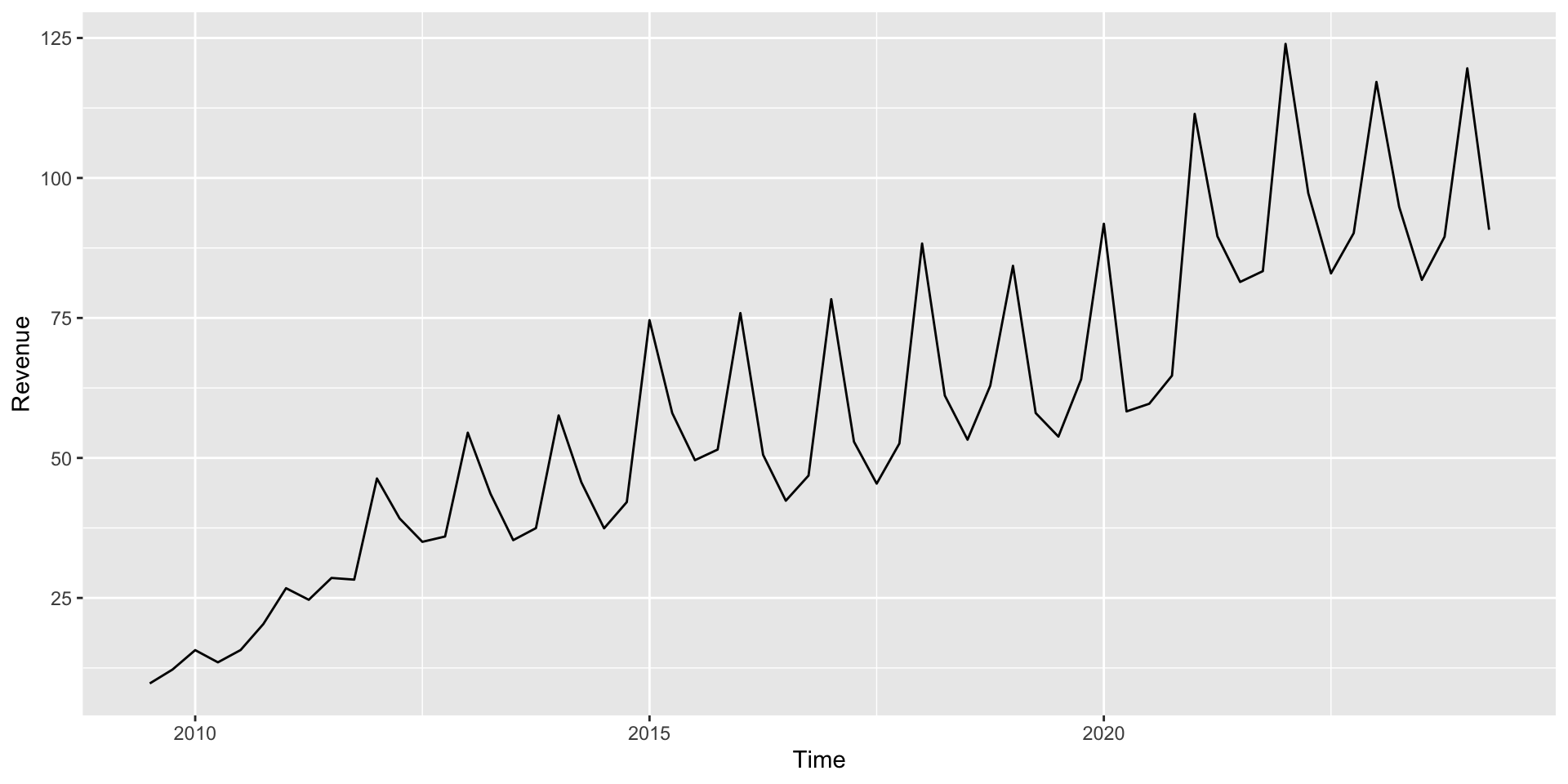

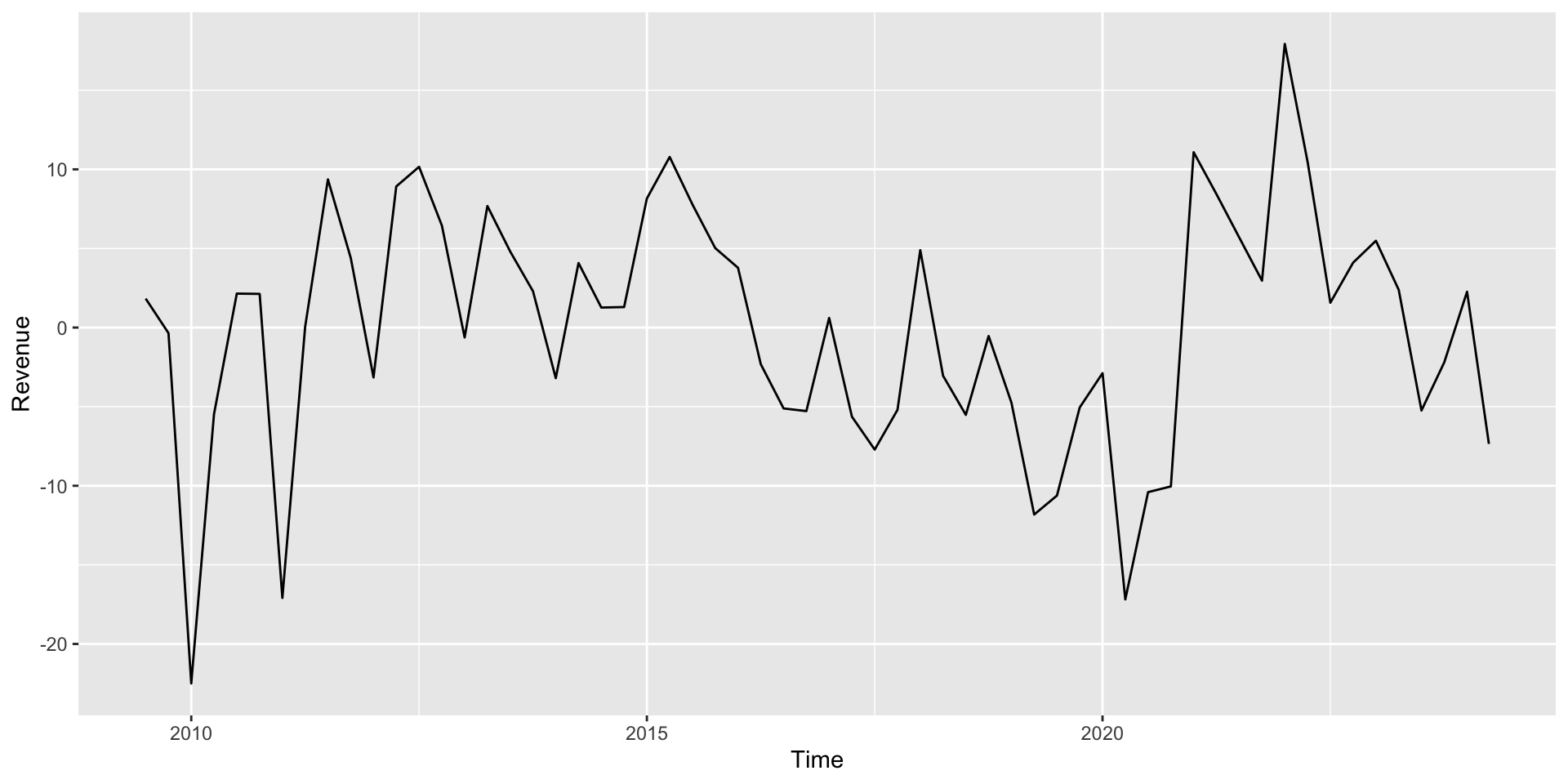

- Apple quarterly revenue (Billions of dollars)

- Goal: What is the pattern here, and how can we forecast future earnings?

What are time series?

- Data where the cases represent time: data collected every day, month, year, etc.

- Time series are important for both explaining how variables change over time and forecasting the future

- Examples of time series data:

- Google’s closing daily stock price every day in 2020

- Inventory levels of each item at a retail store at the end of every week in 2020

- Number of new COVID cases in the US each day since the start of the pandemic

- Apple’s quarterly revenue since 2009

Anatomy of a time series

Some notation:

\(t = 1,2,3,...\), time index

\(Y_t\), is the value: of the variable of interest at time \(t\)

\(Y_t\) may be composed of one or more components:

Trend

Seasonal

Cyclical

Random

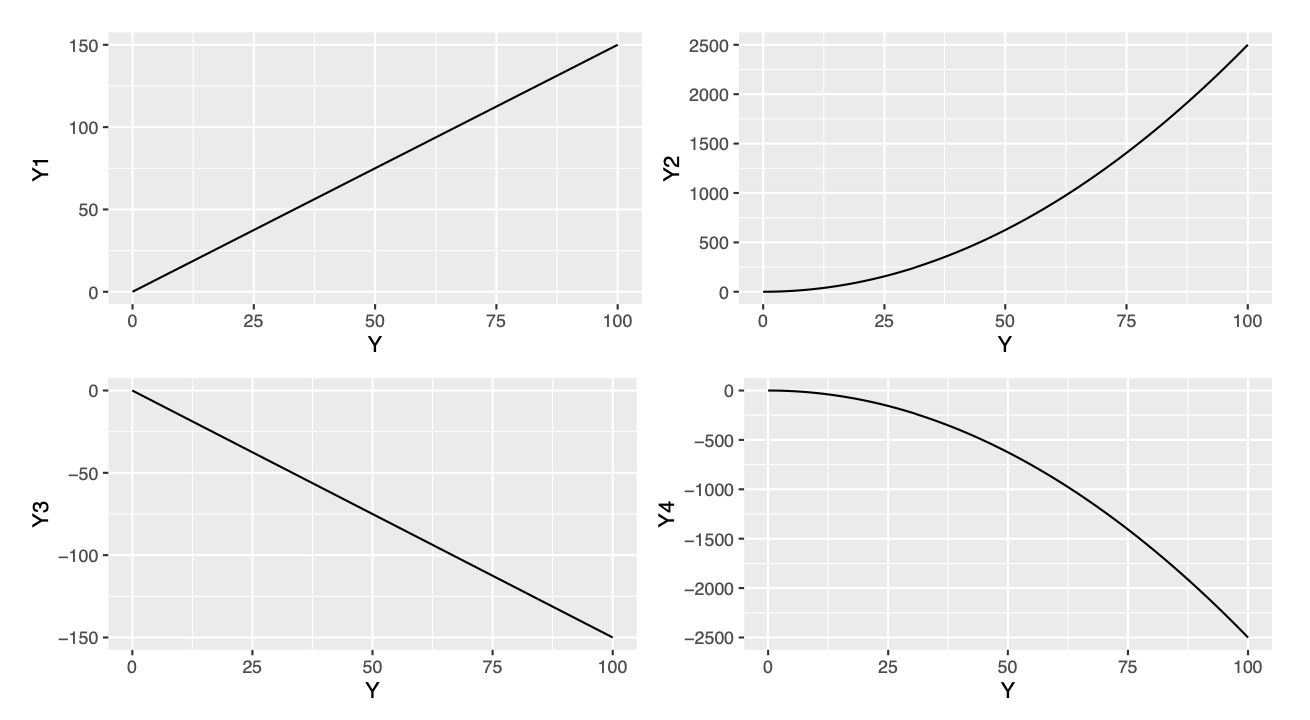

Trend component

- A trend is persistent upwards or downwards movement in the data (not necessarily linear).

Trend component

- Example: Moore’s Law (accelerating increase of transistor count)

- Example: US population over time

- A time series with no trend is called stationary.

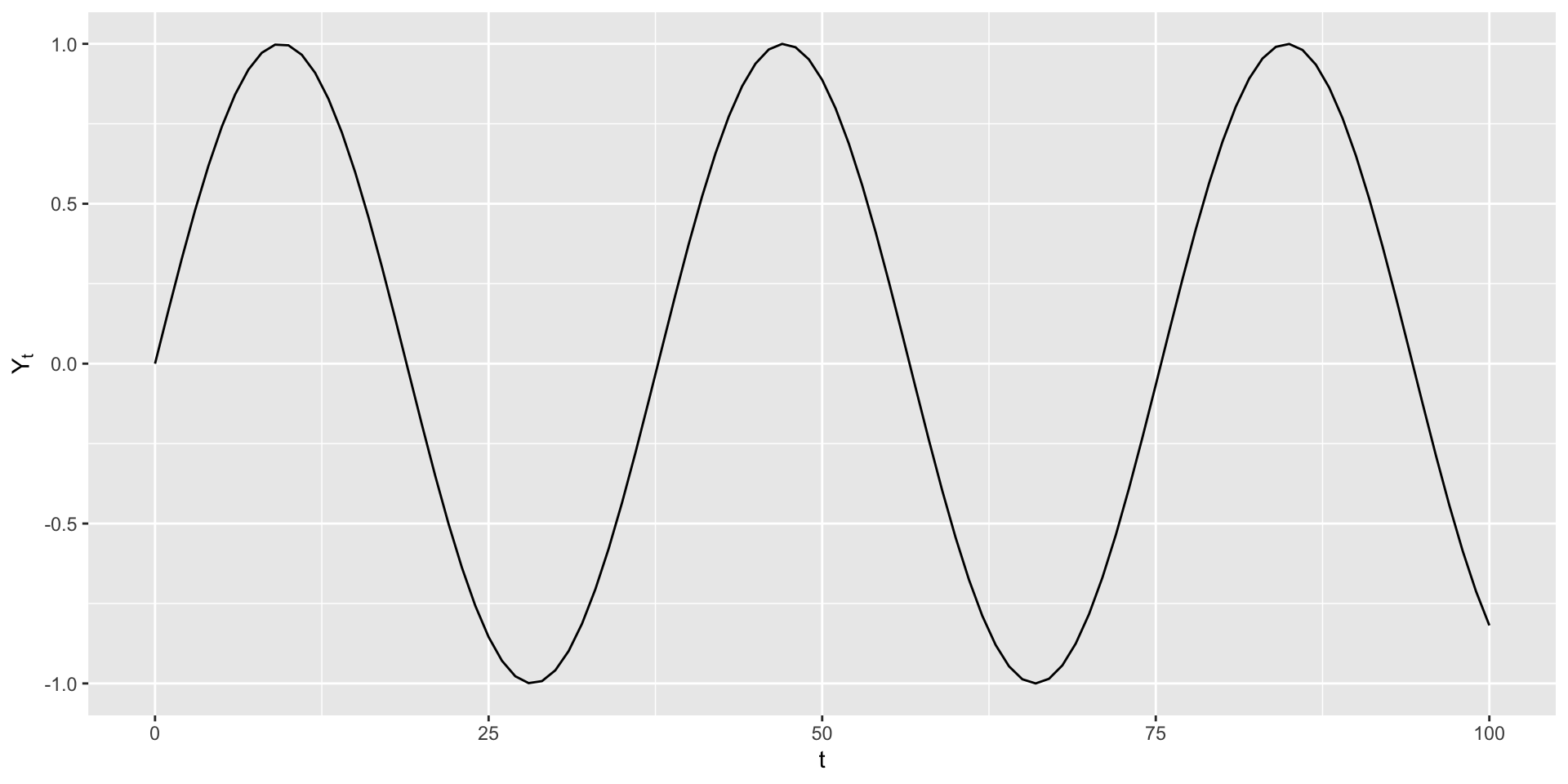

Seasonal component

- Seasonal fluctuation occurs when predictable up or down movements occur over a regular interval.

Seasonal component

- The ups and downs must occur over a regular interval (e.g., every month, or every year)

- Example: Highway traffic volume is highest during rush hour every day

- Example: Supermarket sales may be highest every month right after common paydays like the 15th and 30th

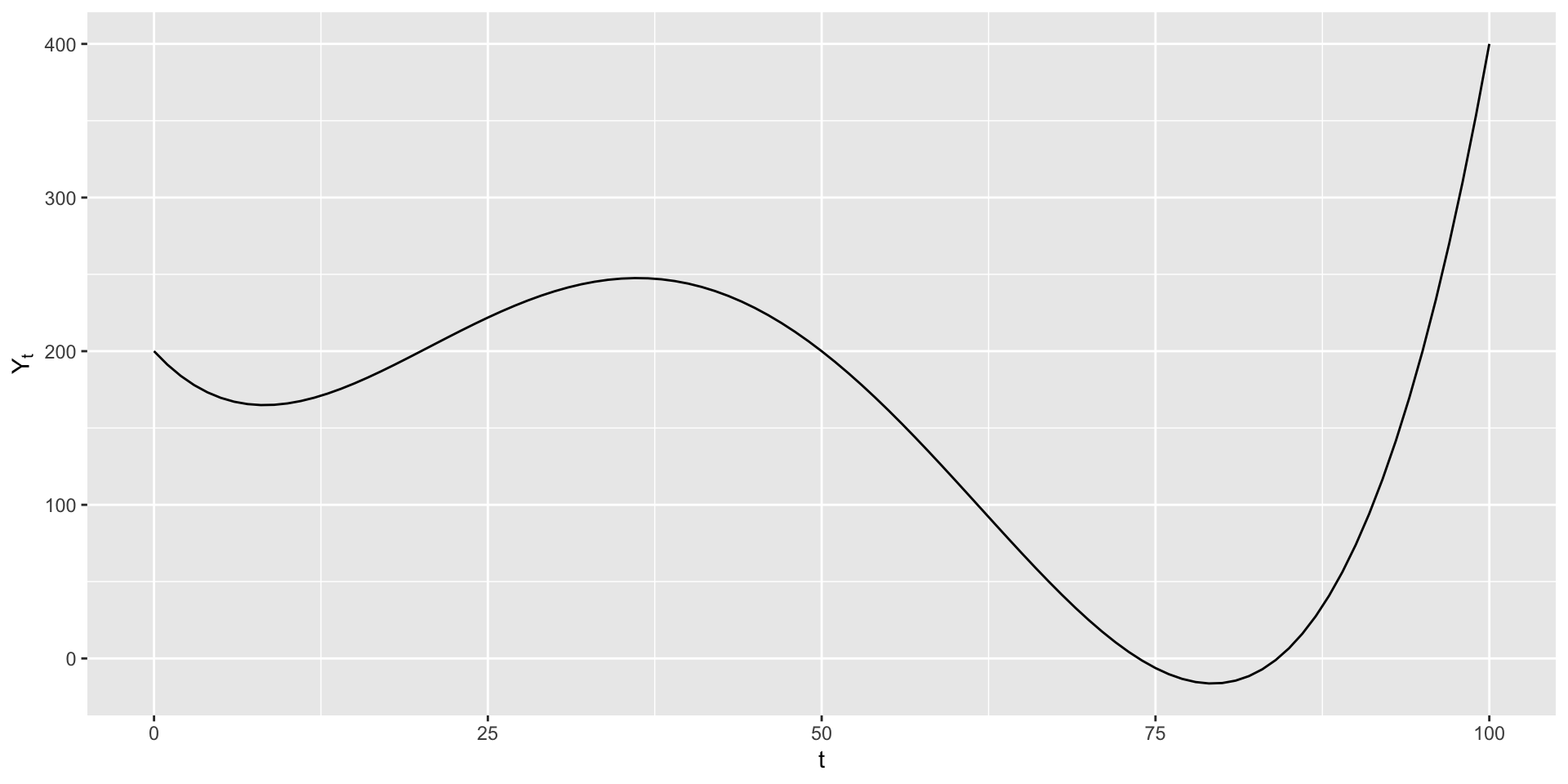

Cyclic component

- Cyclic fluctuations occur at unpredictable intervals, e.g. due to changing business or economic conditions.

Cyclic component

- In contrast to seasonal fluctuations, cyclic fluctuations do not occur at regular, predictable intervals

- It may be possible to predict cyclic components based on some other (non-time) variable

- Example: Restaurant sales dropped dramatically in 2020 due to COVID, as people ate out less

- Example: Sales of bell bottoms rose in the 60s and 70s, declined by the 80s, and then had a resurgence in the 90s

Remainder/Error component

- Any real time series will always have random noise as well, which can’t be predicted or forecast.

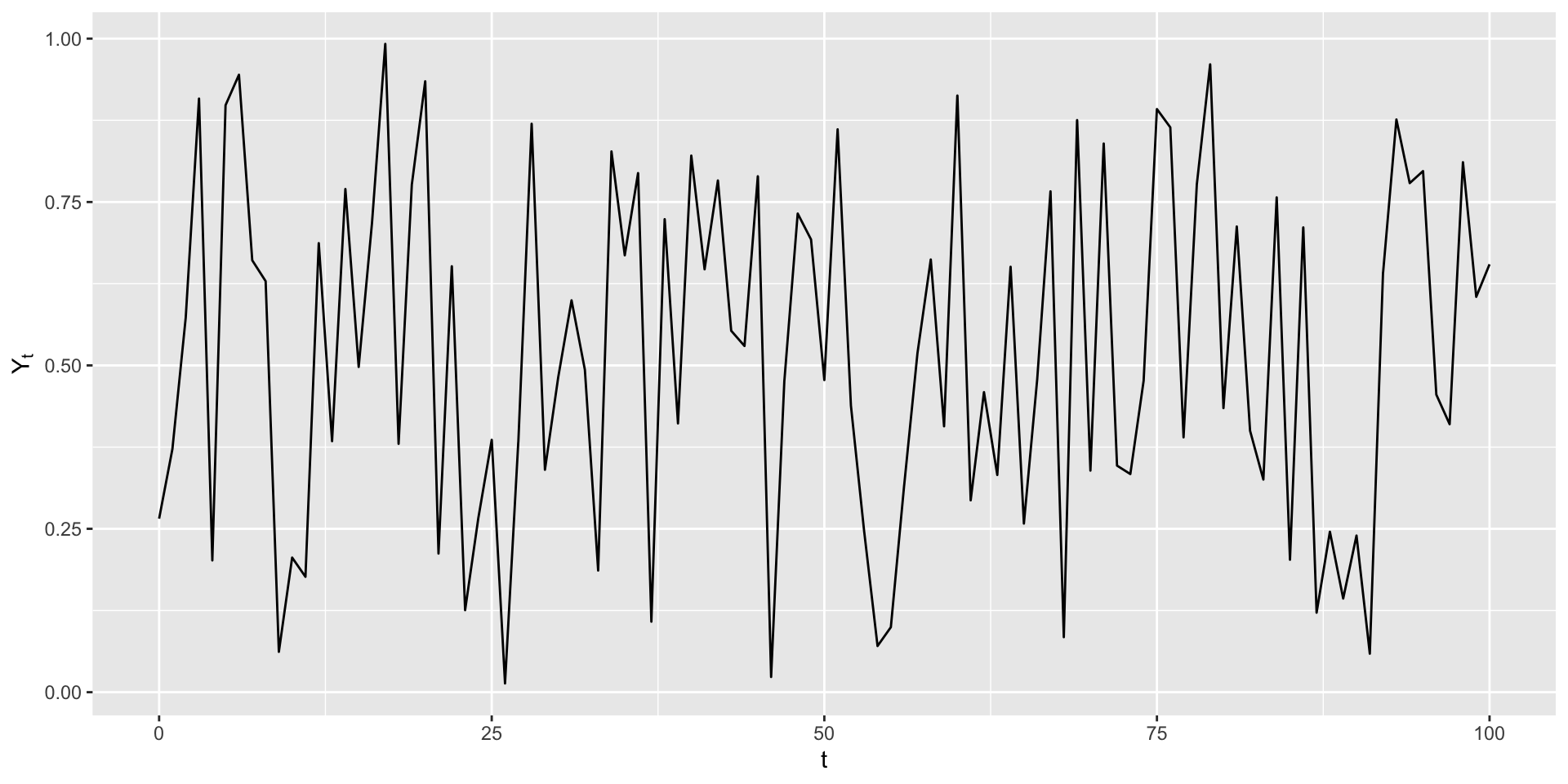

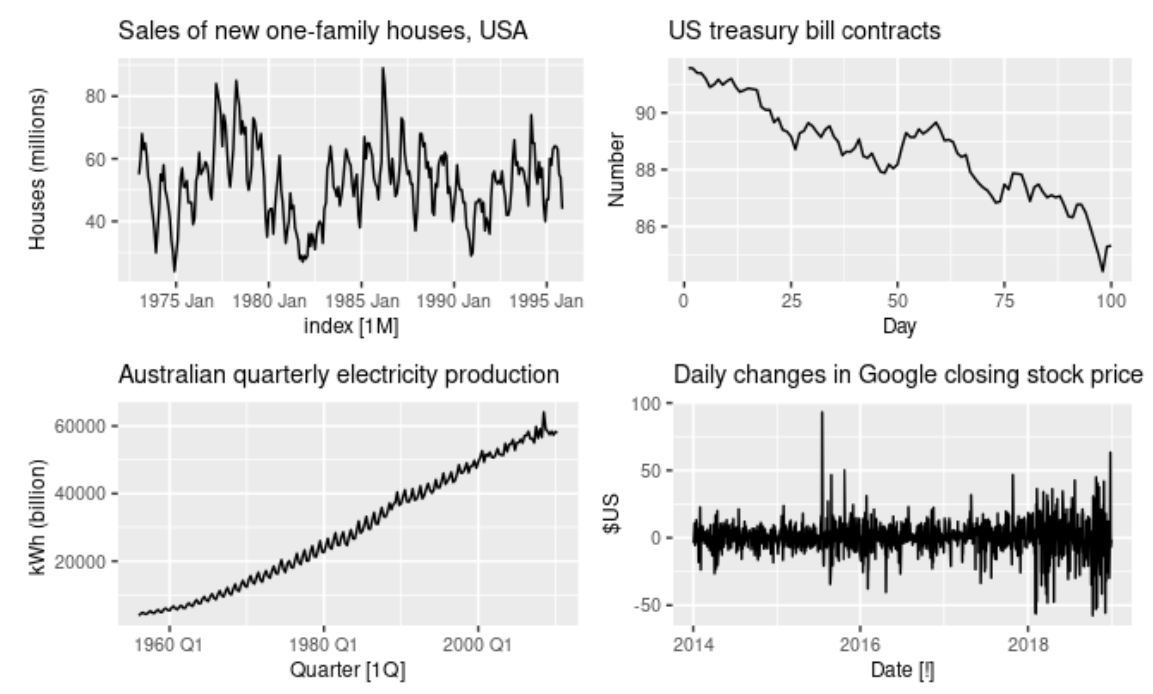

Time Series Components

- Which component(s) you see in each of these time series?

Putting these together

Real time series will usually include a combination of these four components. We will model the time series \(Y_t\) either additively:

\[ Y_t = \text{Trend} + \text{Seasonal} + \text{Random} = T_t +S_t +E_t \] Or multiplicatively: \[ Y_t = \text{Trend}\cdot\text{Seasonal}\cdot\text{Random}= T_t \cdot S_t \cdot E_t \] * (\(E_t\) consists of both the cyclic and error components, as both are unpredictable.) This model can be rewritten as a log model: \[ \log{Y_t} = \log(T_t) + \log(S_t) + \log(E_t) \]

Additive models

\[ Y_t = \text{Trend} + \text{Seasonal} + \text{Random} = T_t +S_t +E_t \]

Most appropriate when seasonal fluctuations are consistent (do not increase or decrease over time)

The trend component \(T_t\) is a function of t (e.g., linear or quadratic)

The seasonal component \(S_t\) is a set of dummy variable representing “seasons”

So we can estimate additive models using regular regression

Additive decomposition

- Run a regression predicting \(Y\) as a function of:

- \(t\), \(t^2\), \(\log(t)\) etc (the trend component \(T_t\))

- Dummy variables for the seasons (the seasonal component \(S_t\))

- To make a prediction for \(Y\), plug into the model!

- The residuals of this model correspond to the error component \(E_t\)

Apple quarterly revenue

- What components do you see here?

Fitting additive model

Call:

lm(formula = Revenue ~ Period + Quarter, data = apple)

Residuals:

Min 1Q Median 3Q Max

-22.496 -5.135 1.280 4.923 17.928

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 33.93619 2.74731 12.353 < 2e-16 ***

Period 1.41324 0.05917 23.884 < 2e-16 ***

QuarterQ2 -20.62657 2.89298 -7.130 2.31e-09 ***

QuarterQ3 -27.44818 2.89480 -9.482 3.62e-13 ***

QuarterQ4 -24.20276 2.89298 -8.366 2.22e-11 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 7.921 on 55 degrees of freedom

Multiple R-squared: 0.9269, Adjusted R-squared: 0.9216

F-statistic: 174.4 on 4 and 55 DF, p-value: < 2.2e-16Interpretation of the model

The trend that we can infer from the variable

Periodindicates a positive growth in revenue of US$ 1.4 billion for each increase in the periods.The seasonal from the

Quartercomponent indicates:

Q2’s are expected to be $20.7 worse thanQ1’sQ3’s are expected to be $27.4 worse thanQ1’sQ4’s are expected to be $24.2 worse thanQ1’sQ3’s are significantly worse thanQ1’s

- These effects are statistically significant (

confint(lm_additive)) - The RSE from this model is US$ 7.921 billions of dollars.

- How can we interpret these results?

Fitting additive model

Fitting additive model

- What does the final model predict from the

Quartercomponent indicates: for Apple in 2024Q3?

fit lwr upr

1 92.69571 75.86745 109.524- The actual revenue was US$ 85.78 billions

- What does the final model predict from the

Quartercomponent indicates: for Apple in 2030Q1? (Should we trust that prediction?)

Fitting additive model

- The residuals from this model show the “detrended and deasonalized” data (but there’s still some trend left!):

- We hadn’t yet dealt with the time dependence

Autorgression model

How we deal with the time dependence ? Key idea: Instead of predicting \(Y_t\) as a function of \(t\) (or other variables), predict \(Y_t\) as a function of \(Y_{t-1}\): \[ Y_t = \beta_0 + \beta_1 Y_{t-1} + e_t \]

\(Y_{t-1}\) is called the “1st lag” of \(Y\)

This is called autoregressive (AR) because it predicts the values of a time series based on previous values

The model above is an AR(1) model

We can have AR(\(p\)) models, with lag \(p\)

Autocorrelation

Autocorrelation, is the correlation of \(Y_t\) with each of its lags \(Y_t, Y_{t−1},\dots\) \[ Cor(Y_t, Y_{t−1}), Cor(Y_t, Y_{t−2}),\dots \]

We also have the autocorrelation of the residuals, \(r_t\)’s, which indicates that there’s a strong indication that the independence assumption is violated \[ Cor(r_t, r_{t−1}), Cor(r_t, r_{t−2}),\dots \]

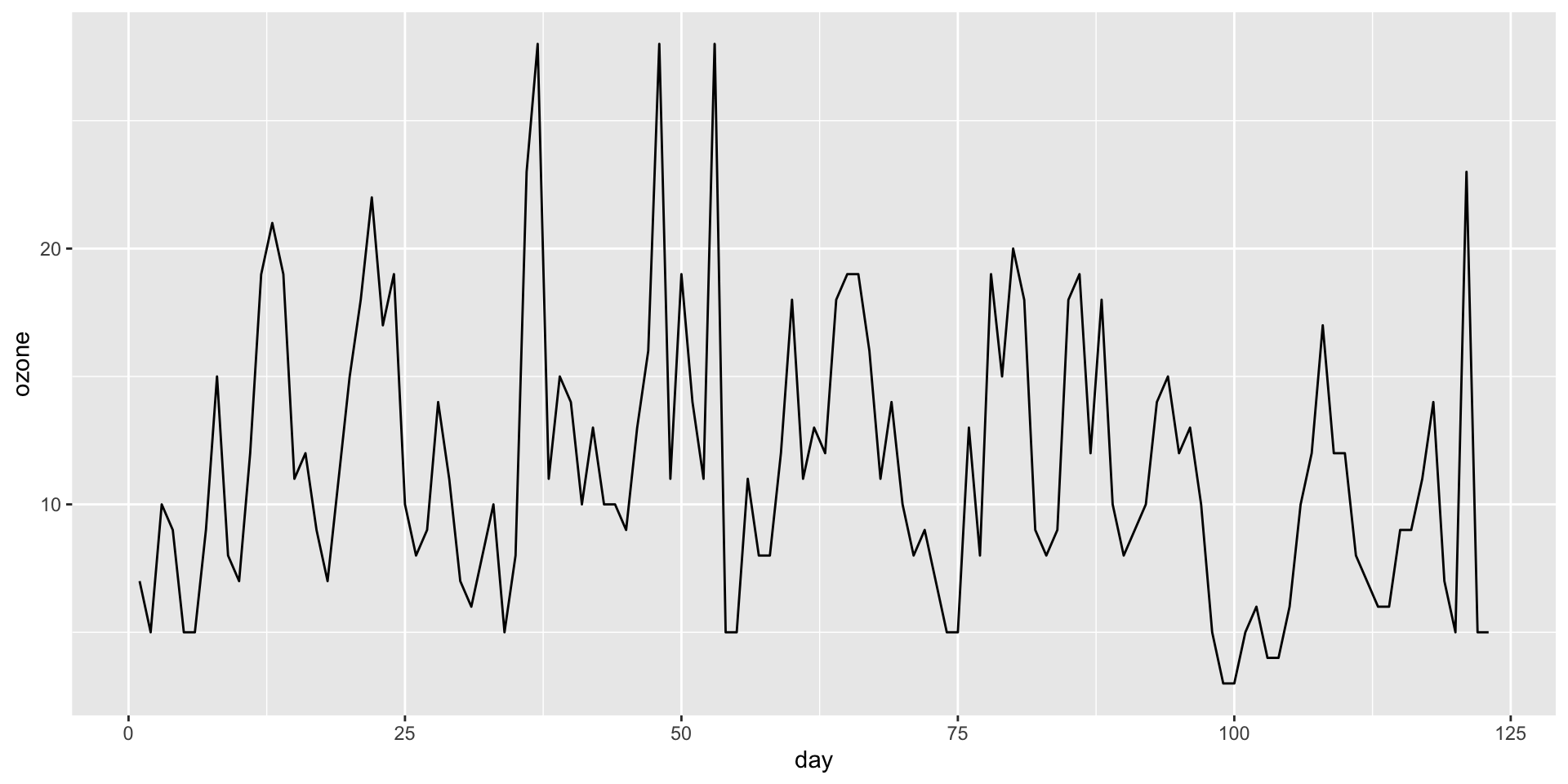

Ozone example

- Creating an AR(1) model: Daily ozone levels in Houston

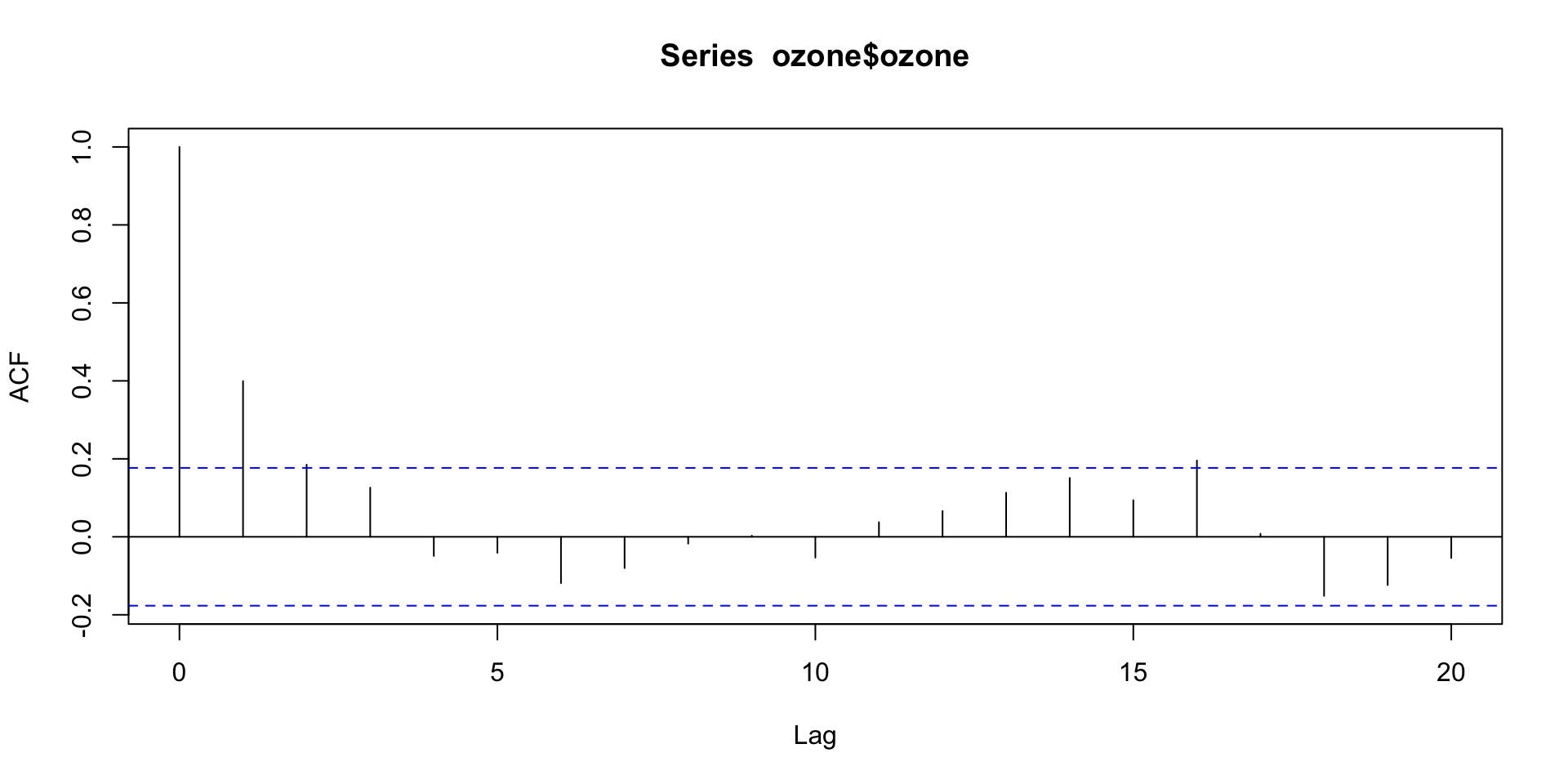

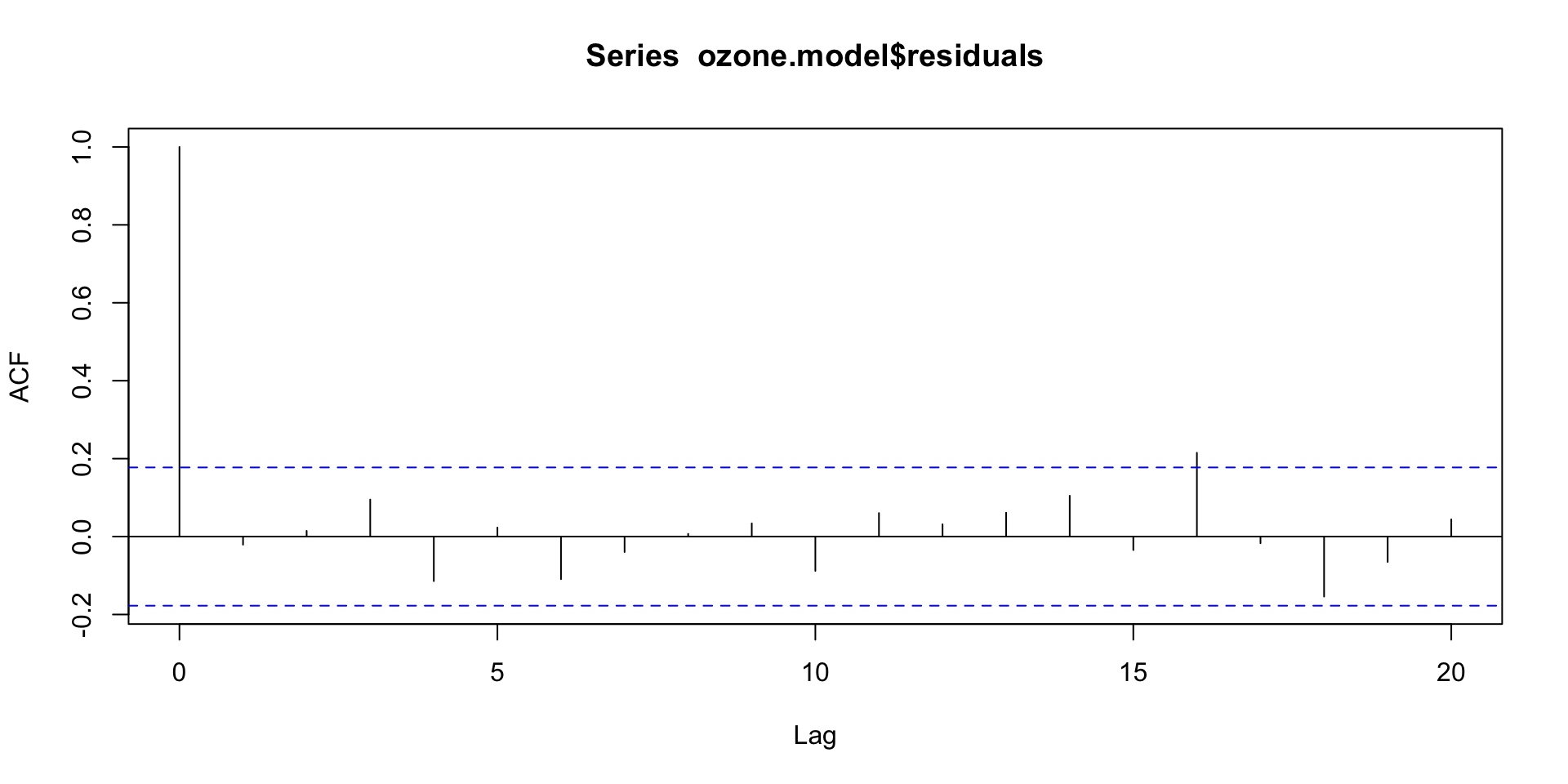

ACF plot

- Visualizing the autocorrelation function (ACF)

- Autocorrelations outside of the dashed blue lines are statistically significant.

Autorgression of the model

- We use the

lagfunction to create the lagged observations

ozone <- ozone %>%

mutate(lag1=lag(ozone))

ozone.model = lm(ozone ~ lag1, data=ozone)

summary(ozone.model)

Call:

lm(formula = ozone ~ lag1, data = ozone)

Residuals:

Min 1Q Median 3Q Max

-13.192 -3.464 -1.108 2.679 16.679

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.87446 1.06976 6.426 2.76e-09 ***

lag1 0.40419 0.08381 4.823 4.20e-06 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 4.999 on 120 degrees of freedom

(1 observation deleted due to missingness)

Multiple R-squared: 0.1624, Adjusted R-squared: 0.1554

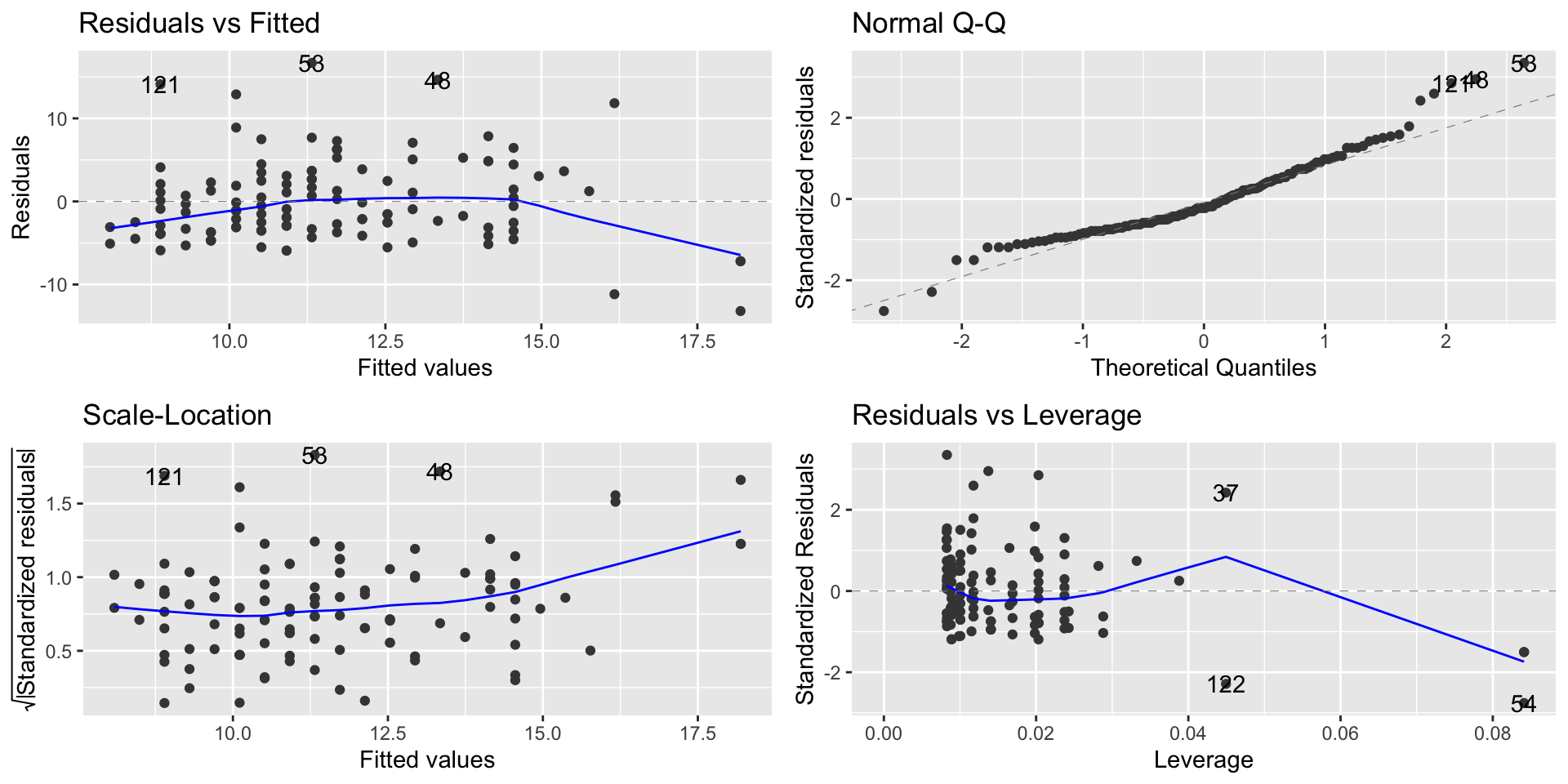

F-statistic: 23.26 on 1 and 120 DF, p-value: 4.197e-06Assumptions of an AR(1) model

Linearity, Normality, Equal Variance: Check using residual plot (linearity + homoscedasticity), Q-Q plot (normality), scale/location (homoscedasticity) like any other regression model

Independence: Since this is a time series, we can actually check this by looking at the autocorrelation of the residuals (we want no significant autocorrelation)

Autoplot

- Linearity, Normality, Equal Variance

ACF of the residuals

- We expect 5% of autocorrelations to be significant just by chance, so having just 1 out of the 20 lags flagged as significant indicates we are OK on independence!

Making predictions in time series

| Type | Model | Predicted \(Y_t\) |

|---|---|---|

| White noise | \(Y_t = e_t\) | \(0\) |

| Random sample | \(Y_t = \beta_0 + e_t\) | \(\widehat{\beta}_0\) (or average \(Y\)) |

| Random walk | \(Y_t = \beta_0 + Y_{t-1} + e_t\) | \(\widehat{\beta}_0 + Y_{t-1}\) |

| General AR(1) | \(Y_t = \beta_0 + \beta_1 Y_{t-1} + e_t\) | \(\widehat{\beta}_0 + \widehat{\beta}_1 Y_{t-1}\) |

- Unit root occurs when \(\beta_1 = 1\). This means:

- The series is a random walk.

- There’s no mean reversion, and any shocks will have a permanent effect.

- When \(\beta_1 = 1\), the model is non-stationary, meaning the series tends to “drift” without stabilizing around a fixed mean.

- If \(|\beta_1| < 1\), the series is mean-reverting, and shocks are temporary.

Statistical Analysis

- The coefficient \(\widehat{\beta}_1\) is associated with the variable

lag1. - In this case, for the larger population, with 95% confidence, \(\widehat{\beta}_1\) lies between 0.24 and 0.57.

- This means that \(|\beta_1| < 1\), indicating that the series is mean-reverting.

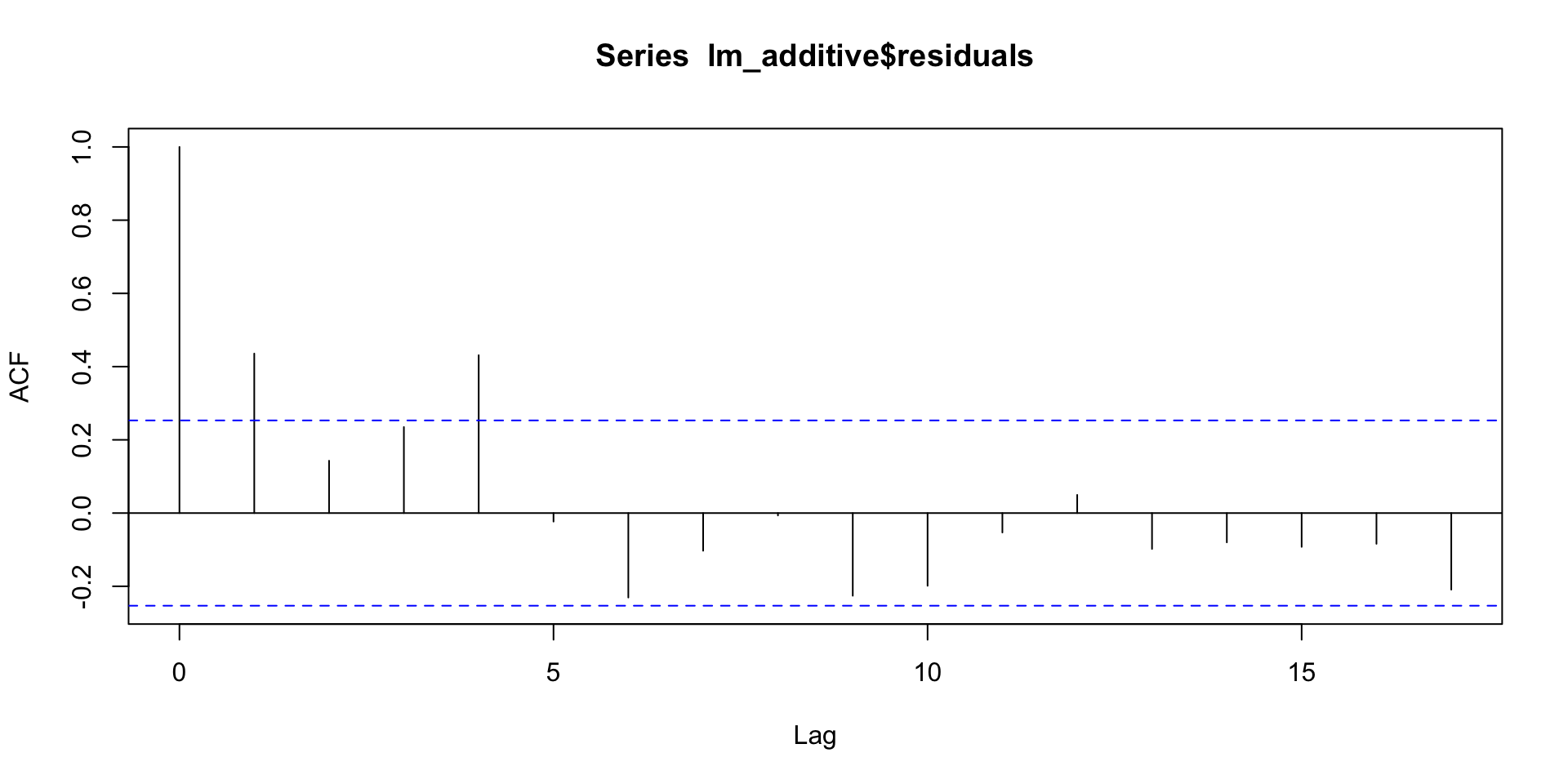

Apple Revenue ACF plot

- ACF plot of the residuals of the additive model.

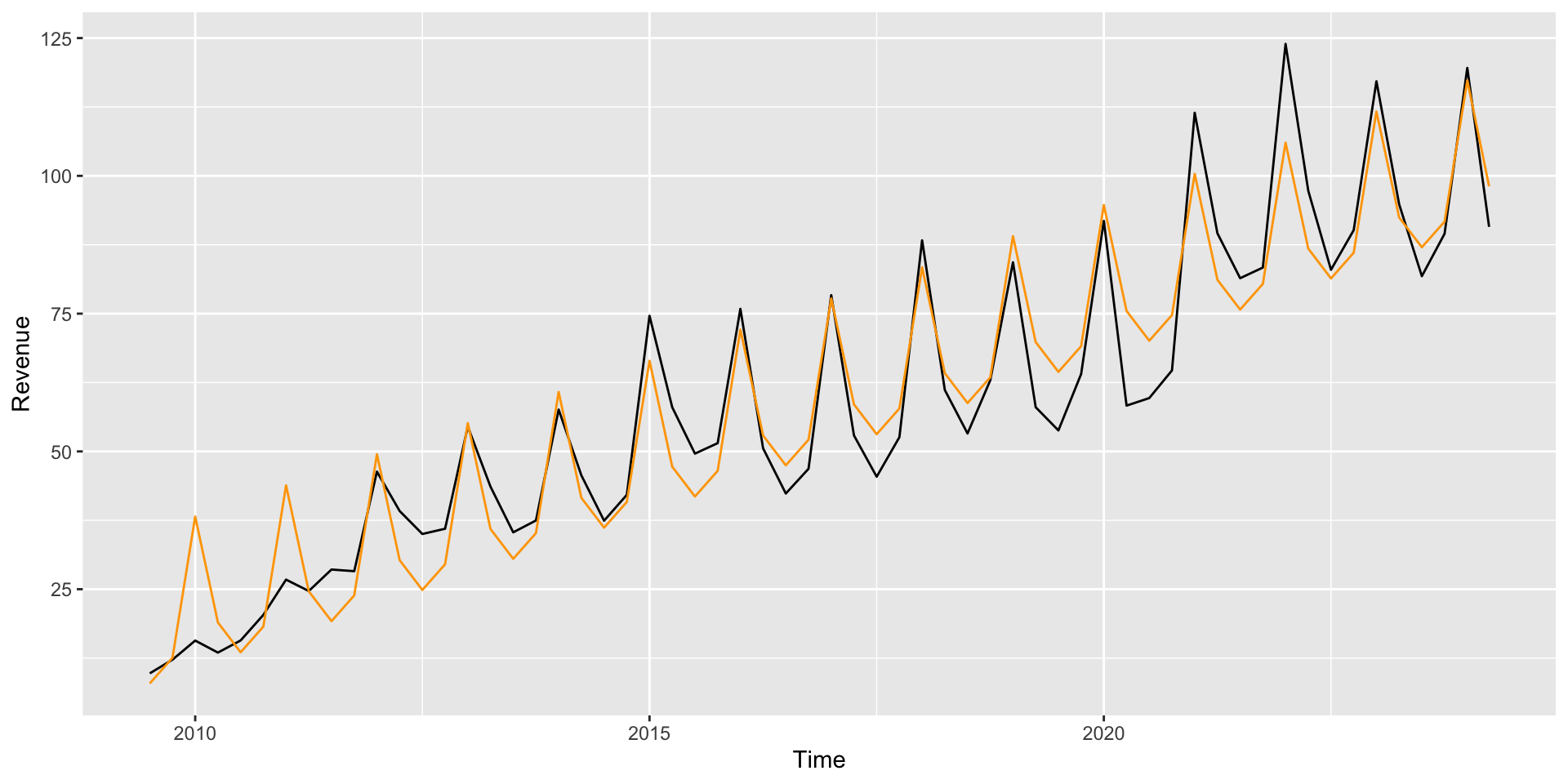

Apple Revenue

- Combining decomposition and autoregression in a multiplicative model

\[ \log(\texttt{Revenue}_t) = \log(\texttt{Period}_t) + \texttt{Quarter}_t + \log(\texttt{Revenue}_{t-1}) \]

We need to create the lag variable.

It will have only one lag, and thus is an AR(1) model.

Apple Revenue

Call:

lm(formula = log(Revenue) ~ log(Period) + Quarter + log(lag1),

data = apple)

Residuals:

Min 1Q Median 3Q Max

-0.204851 -0.056602 0.005991 0.066084 0.193337

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.14400 0.17945 6.375 4.56e-08 ***

log(Period) 0.20622 0.06918 2.981 0.00433 **

QuarterQ2 -0.53559 0.04911 -10.906 3.72e-15 ***

QuarterQ3 -0.47076 0.03397 -13.859 < 2e-16 ***

QuarterQ4 -0.31872 0.03346 -9.526 4.47e-13 ***

log(lag1) 0.63410 0.10109 6.273 6.65e-08 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.09013 on 53 degrees of freedom

(1 observation deleted due to missingness)

Multiple R-squared: 0.9751, Adjusted R-squared: 0.9728

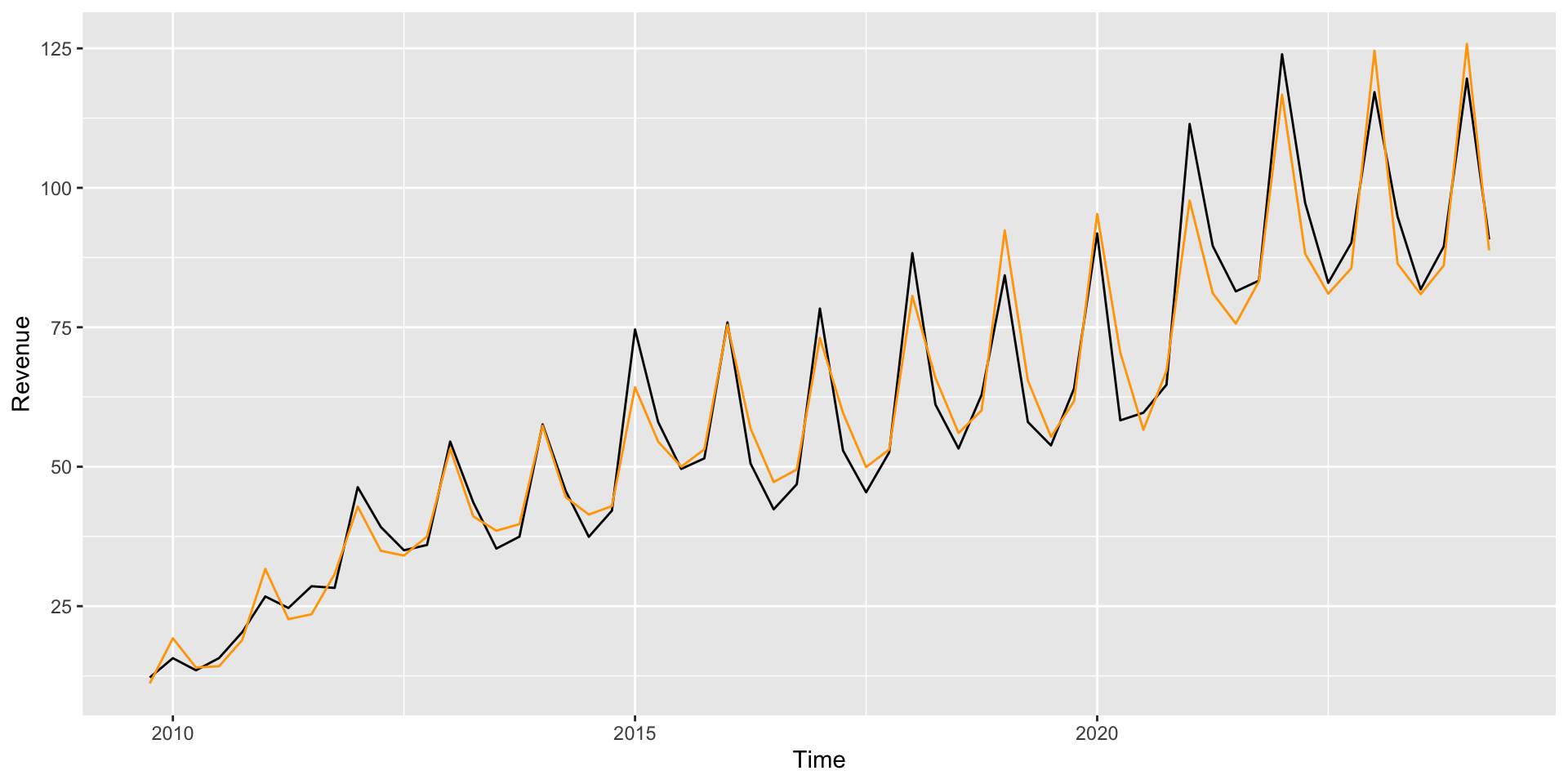

F-statistic: 415.4 on 5 and 53 DF, p-value: < 2.2e-16Apple Revenue Predictions

- Predictions of multiplicative model

Apple Revenue Predictions

- Confidence interval of the multiplicative model

2.5 % 97.5 %

(Intercept) 0.78406737 1.5039420

log(Period) 0.06746219 0.3449861

QuarterQ2 -0.63409896 -0.4370871

QuarterQ3 -0.53888914 -0.4026276

QuarterQ4 -0.38583509 -0.2516142

log(lag1) 0.43133359 0.8368601The slope associated with lag is statistically significant, and its value is between minus and plus one; we have that this is a mean-reverting time series.

We also have a better fit (here we feed

lag1with prediction from the previous period, US$ 90.75 billions):

fit lwr upr

1 79.80492 66.06926 96.39618- The confidence interval for the forecast is narrower, and the difference between what we observe and predict is smaller.

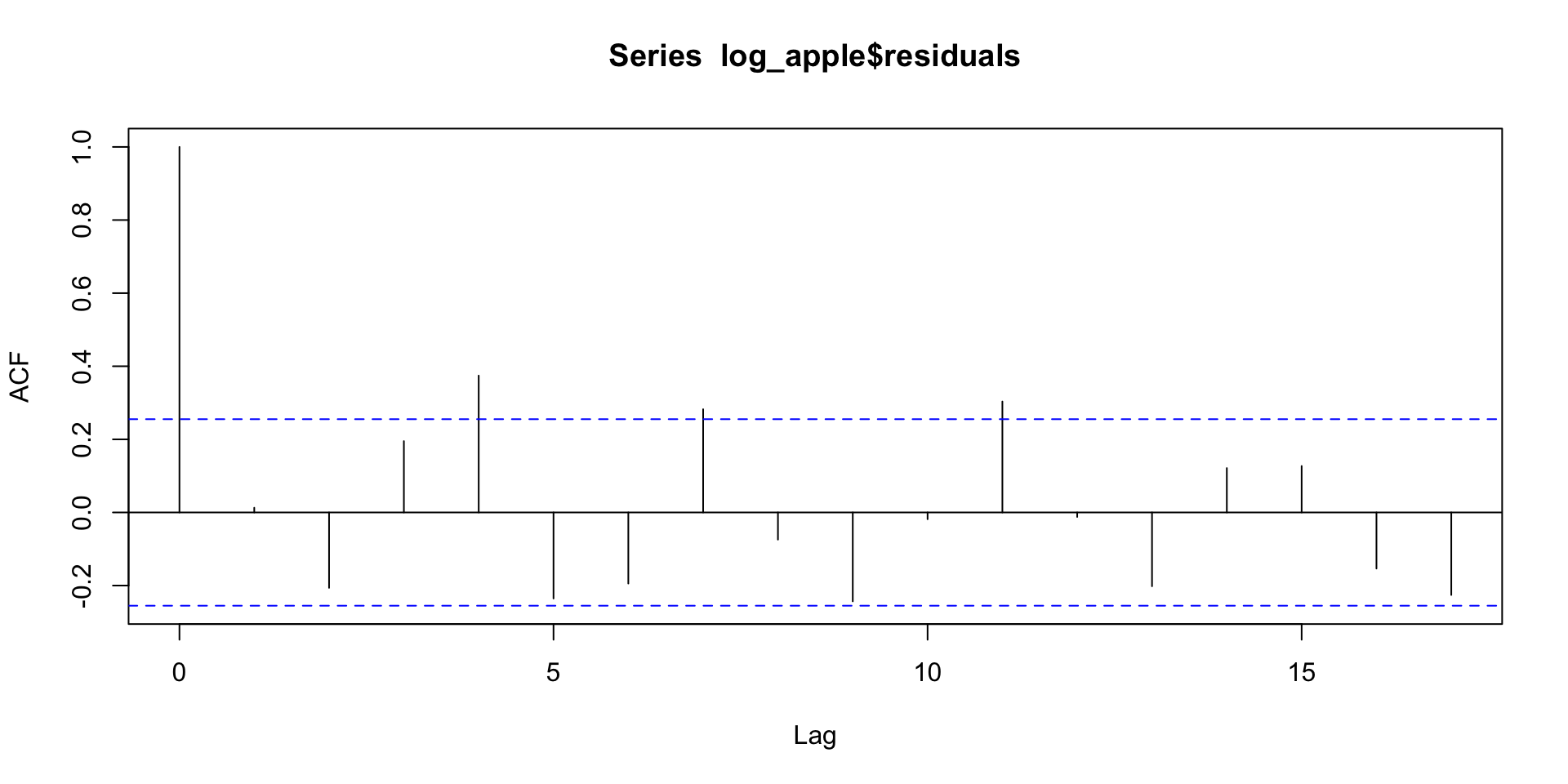

Apple Revenue ACF plot

- ACF plot of the residuals of the multiplicative model.

- The independent assumptions look better, but it might be necessary to add more lags.

Time Series Strategy

To building a time series model:

Start with a an additive or multiplicative model with trend and seasonal components. (Plot your data! If the seasonal variation increases or decreases over time you’ll want a multiplicative model.)

Examine the usual diagnostic plots, and plot your residuals as a function of time. Do you need a (different) nonlinear time trend? A transformation of \(Y\)?

Check your residuals for autocorrelation. If it’s present, add appropriate lag terms to your model.